Tokenomics, or token economics, is the strategic foundation behind how a blockchain project’s token operates. It’s not just about setting a token supply or imagining what it might be worth at launch. The real work is designing a system where the token shapes user behavior, supports ecosystem growth, and holds long-term value. In Web3, tokenomics is product design at its core.

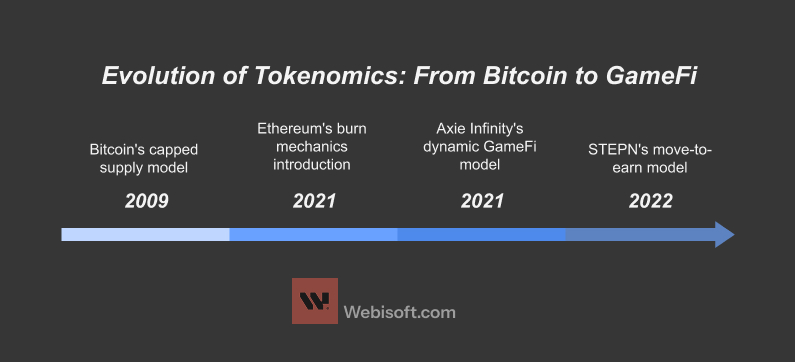

When you design tokenomics well, you create an economy where users, developers, validators, and investors all have reasons to engage and contribute. Done poorly, tokenomics can lead to inflation, speculative dumping, or even a complete collapse of the project. We’ve seen both outcomes play out. The Terra LUNA and UST crash showed how dangerous flawed incentives and artificial demand can be. Meanwhile, Ethereum’s tokenomics have evolved over time. With upgrades like EIP-1559 and the shift to staking, it has moved toward a deflationary model while supporting one of the largest ecosystems of builders and users.

A strong token economy answers a few key questions:

- Why does this token exist?

- Who earns it, who spends it, and for what reasons?

- What gives the token value beyond pure speculation?

In today’s world of DeFi, GameFi, DAOs, and Layer 2 networks, tokenomics is no longer just a whitepaper section. It shapes how capital flows, how governance works, who stays engaged, and whether a project can survive once the hype fades. If you’re exploring token design or planning to build in Web3, you might also want to check our blockchain consulting services or DeFi tokenization solutions for hands-on support.

This guide will break down:

- The core elements of tokenomics, including utility, supply, demand, and incentives

- Types of tokens and their roles in different ecosystems

- Supply models, from fixed to inflationary to deflationary

- Distribution strategies and behavioral drivers

- Governance models and the most common design mistakes

- A practical framework to build or evaluate a token economy

Whether you’re starting a protocol or auditing a token model before investing, this will give you a blueprint for getting tokenomics right.

Contents

- 1 The Core Elements of a Token Economy

- 2 Types of Tokens and Their Economic Roles

- 3 Designing Token Supply: Fixed, Inflationary, Deflationary Models

- 4 Token Distribution Strategies

- 5 Aligning Incentives with Tokenomics

- 6 Governance and Decision-Making in Token Economies

- 7 Common Tokenomics Pitfalls to Avoid

- 8 Tokenomics Design Framework (Step-by-Step Guide)

- 8.1 1. Define Your Ecosystem Goals

- 8.2 2. Choose Your Token Type(s)

- 8.3 3. Define Utility and Demand Drivers

- 8.4 4. Design the Supply and Inflation Model

- 8.5 5. Plan Distribution and Vesting

- 8.6 6. Align Incentives with Stakeholder Actions

- 8.7 7. Outline Your Governance Structure

- 8.8 8. Test for Sustainability

- 9 FAQs About Tokenomics

- 10 Conclusion: Sustainable Tokenomics Is Product Design

The Core Elements of a Token Economy

A strong blockchain project isn’t just built on code. It relies on a well-designed token economy that gives people real reasons to engage. When tokenomics works, it supports lasting utility, healthy demand, and user behavior that sustains the ecosystem long after the initial hype fades. Let’s break down the core building blocks that shape a token economy.

Token Utility

A token without utility doesn’t offer much beyond speculation. Token utility describes what the token is actually used for inside your ecosystem. The stronger and clearer the utility, the more likely people are to adopt and stick around.

Tokens can play different roles:

- Access: Let users unlock features, tools, or premium services. For example, GRT gives access to querying services on The Graph.

- Staking: Allow holders to lock tokens to secure the network or earn rewards. Ethereum’s transition to proof of stake is a prime example.

- Governance: Let holders vote on proposals, upgrades, or budgets. This is common in protocols like AAVE and Uniswap.

- Transaction fees: Use tokens to pay for gas or execution costs. ETH and BNB are well-known here.

- Work incentives: Reward contributors, validators, or miners for keeping the system running. Filecoin and Helium both follow this model.

Many utility tokens are designed to do more than one of these things. BNB, for example, is used for trading fee discounts, gas fees on BSC, and participation in token launches. The first step in strong tokenomics is mapping out practical, repeatable uses for your token. If you’re looking to build this into your project, our blockchain product development services can help align your utility design with long-term goals.

Token Supply Mechanics

Your supply model shapes how people see your token’s value now and in the future. It also influences long-term price pressure and trust.

Common models include:

- Fixed supply: Like Bitcoin’s 21 million cap. This creates scarcity and supports store-of-value narratives.

- Inflationary: New tokens are minted continuously, as Ethereum did before its merge. This encourages participation but can dilute value over time.

- Deflationary: Tokens are burned through fees or buybacks. BNB burns and ETH’s EIP-1559 are examples of this in action.

- Disinflationary: The inflation rate slows over time. Bitcoin’s halving schedule shows how this works in practice.

Successful projects balance supply with demand. If new token issuance grows faster than demand, the token loses value. If you’re exploring how to balance this in a live environment, our DeFi tokenization services cover both technical design and economic modeling.

Demand Drivers

Utility and supply are important, but without demand, a token can’t hold value. Demand keeps the ecosystem active and sets a price floor.

Strong demand usually comes from:

- Real utility: Tokens that pay for essential services like compute, storage, or governance inside a dApp.

- Speculation: This still plays a role, especially early on or during market booms.

- Staking and yield incentives: Locking tokens to earn yield increases demand. Projects like Curve and Lido have grown large communities this way.

- Scarcity or deflation: Limited supply or burn mechanisms help strengthen perceived value.

The goal is to create real reasons for people to want and hold your token, not just chase short-term gains.

Incentive Design

Tokens aren’t just currency in Web3. They are tools that help guide user behavior in a decentralized setting. Good incentive design ensures users, validators, builders, and investors all act in ways that strengthen the network.

For example:

- Users: Get rewards like discounts, cashback, or early access.

- Validators and miners: Earn block rewards or priority fees for keeping the network secure.

- Builders and developers: Receive grants or retroactive payouts for creating value.

- Investors: Gain governance rights, staking yields, or other forms of long-term upside.

When incentives are designed thoughtfully, they align everyone’s interests and help the ecosystem thrive.

Pro Tip: Design for incentives, not just speculation. The best token models reward users for contributing to network growth—not just holding and hoping.

Together, utility, supply mechanics, demand dynamics, and incentives form the backbone of a sustainable token economy. These aren’t just checkboxes—they’re interdependent variables that determine whether your token thrives or dies out after launch.

Types of Tokens and Their Economic Roles

Not all crypto tokens serve the same purpose. If you want to design or evaluate a token economy that works in practice, it’s important to understand the different types of tokens and the roles they play. Each type has its own function, value drivers, and regulatory considerations. Let’s break down the five most common token types you’ll encounter in Web3.

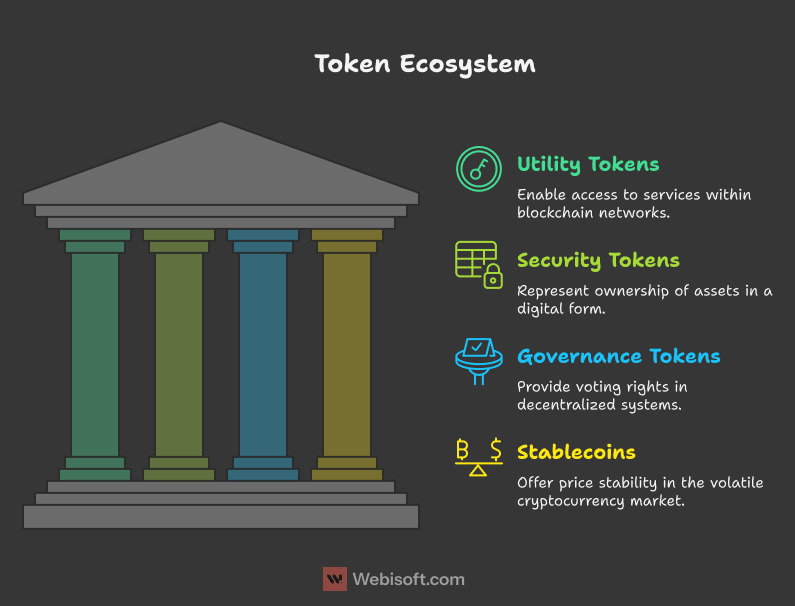

Utility Tokens

Utility tokens are the most common type of token in blockchain ecosystems. They exist to power usage within a specific network. This might mean accessing services, paying fees, or participating in some core function of the platform.

These tokens are not designed as investments. Their value comes from utility — not from a promise of profit.

Examples:

- BNB is used to pay transaction fees and access services on Binance and BNB Chain.

- UNI helps users interact with governance processes and liquidity mining on Uniswap.

If no one needs the token to use the app, the token loses relevance. Strong product-market fit is essential. If you’re designing utility-driven ecosystems, our blockchain development services can help align the tech with lasting value.

Security Tokens

Security tokens represent real-world financial assets or ownership stakes in digital form. They are regulated like traditional securities, which means they fall under the laws of the jurisdictions where they are issued. Security Token Offerings (STOs) are the usual method of issuing them.

These tokens might represent:

- Equity shares in a company

- Debt instruments or digital bonds

- Revenue-sharing agreements or fractional ownership

If you are building or promoting a security token, compliance is non-negotiable. It must be designed into the system from the start.

Governance Tokens

Governance tokens give holders a say in how a protocol evolves. They let people vote on upgrades, treasury spending, or rule changes. The value of these tokens comes from the ability to influence decisions — not from direct utility or yield.

Examples:

- AAVE tokens allow voting on lending parameters and risk frameworks.

- MKR tokens give holders control over MakerDAO’s stability mechanisms.

Successful governance tokens depend on active, informed communities. Without that, decisions fall to a small group, and decentralization breaks down. If you’re exploring governance design, you might find our insights on DAO structures useful.

Stablecoins

Stablecoins are tokens designed to hold a steady value, usually tied to a fiat currency like the US dollar. They serve as a medium of exchange and store of value in most DeFi systems. Without them, everyday trading, lending, and payments would be much harder to manage.

Stablecoins can be:

- Fiat-backed: Like USDC and USDT, backed by dollars or equivalents in reserve.

- Crypto-backed: Like DAI, backed by overcollateralized crypto assets.

- Algorithmic: Like UST (which has faced well-known failures), pegged through supply and demand adjustments without direct backing.

Stablecoins are the financial backbone of DeFi. They help enable reliable transactions without the volatility of other crypto assets.

Non-Fungible Tokens (NFTs)

NFTs are unique digital assets that represent ownership of something specific, whether that’s digital art, collectibles, or game items. Unlike fungible tokens, no two NFTs are the same. They don’t usually form the core of a token economy, but they can play key roles in GameFi, creator ecosystems, and emerging Web3 tools.

Examples:

- Game assets in platforms like Axie Infinity or Immutable X

- Membership NFTs that provide access rights or governance roles

We’re also seeing more utility-based NFTs — for subscriptions, credentials, or even voting. This trend is expanding their role far beyond simple collectibles. If you want to explore NFT integration into token economies, our NFT marketplace development services cover both the tech and the economic layers.

Designing Token Supply: Fixed, Inflationary, Deflationary Models

Token supply isn’t just a technical choice. It’s the backbone of your project’s value story. How you structure supply shapes price dynamics, user incentives, and long-term sustainability. Whether you’re capping supply like Bitcoin or adding burn mechanics like BNB, your decisions around supply will influence how users, speculators, builders, and investors behave.

Let’s break down the most common supply models — with examples of what tends to work and what often doesn’t.

Fixed Supply Tokens

Fixed supply tokens have a hard cap on how many tokens will ever exist. This model leans on digital scarcity, much like gold. Bitcoin is the best-known example:

- A total supply of 21 million BTC

- The block reward halves roughly every four years, slowing new issuance

- Demand rises over time, while supply stays constant, creating upward pressure on price

Fixed supply models appeal to long-term investors who believe in store-of-value assets. But scarcity alone won’t support value if the token lacks meaningful utility. Without demand-side use cases, fixed supply can encourage hoarding and reduce liquidity. If you’re designing this type of token, it’s important to link it to a broader ecosystem.

Best for: tokens aiming to become long-term stores of value

Watch for: hoarding, low velocity, poor liquidity

Inflationary Tokens

Inflationary tokens involve ongoing minting of new supply. This is often done to reward validators, miners, stakers, or contributors.

Examples:

- Dogecoin has no supply cap, adding about 5 billion new DOGE each year.

- Ethereum, before its shift to proof of stake, had a variable inflation rate based on network activity.

Inflation isn’t automatically bad. When tied to productive activity like staking or building, it can secure the network and keep participants engaged. The risk comes when inflation outpaces utility, causing value dilution and short-term sell pressure.

Best for: growing ecosystems that need to encourage participation

Watch for: long-term dilution, inflation outpacing demand

Deflationary Mechanics

Deflationary models reduce the circulating supply over time. This can happen through:

- Token burns, where tokens are permanently destroyed

- Buybacks, where the protocol uses revenue to buy and burn tokens

- Transaction taxes that burn a portion of tokens with every transfer

Examples:

- BNB burns a portion of its trading fee revenue on a regular basis.

- Ethereum, after EIP-1559, burns base transaction fees, which can make ETH deflationary during periods of high activity.

When paired with healthy demand, deflation can support long-term price growth. But if taken too far, it can harm liquidity or discourage people from spending the token.

Best for: mature ecosystems with strong revenue or high transaction volumes

Watch for: artificial scarcity, speculative hoarding

Elastic Supply / Algorithmic Models

Elastic or algorithmic supply models adjust the total supply on the fly to target a price peg or economic balance. These tokens don’t rely on collateral but instead on code that changes supply as conditions shift.

Examples:

- Ampleforth changes its total supply daily based on market conditions.

- Terra tried to maintain UST’s peg by adjusting the supply of UST and LUNA together (which ultimately failed).

While innovative, algorithmic models carry major risks. They depend heavily on market confidence. When that confidence fails, the system can unravel fast, as seen with Terra’s collapse. These models are better suited for experimental designs or DeFi primitives, not core financial infrastructure.

Best for: experimental protocols, DeFi building blocks

Watch for: fragile incentives, risk of collapse, low trust

If you’re exploring supply models for your project or evaluating a token before investing, it’s worth pairing this with strong incentive design and governance planning. Our blockchain consulting services can help map out a supply strategy that aligns with real-world use and long-term growth.

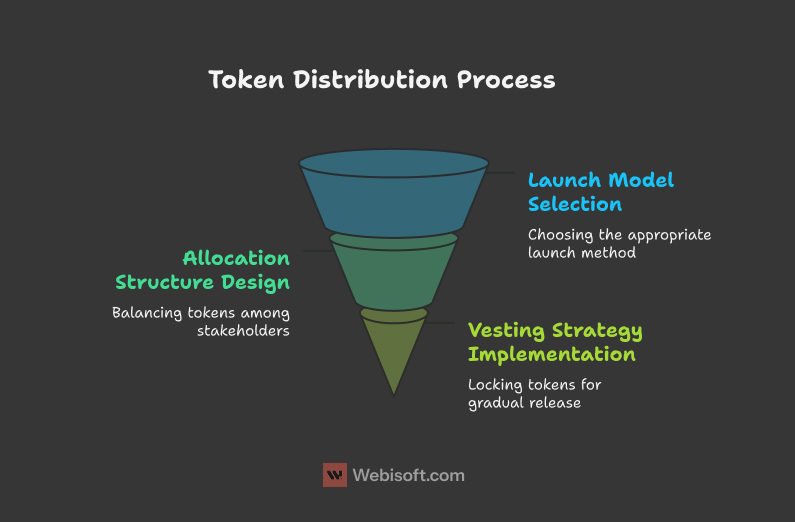

Token Distribution Strategies

How you distribute tokens — both at launch and over time — shapes your project’s credibility as much as how the token works. Distribution affects decentralization, market stability, community trust, and long-term value. In short, who gets tokens, when they get them, and how many they get can determine whether your Web3 project thrives or fails.

Let’s break down the key parts of a well-designed distribution plan: launch model, allocation structure, and vesting strategy.

Fair Launch vs Pre-Mined

A fair launch means no one gets a head start. There are no insiders, no private sales, and no early allocations. Bitcoin is the most famous example. It launched without a pre-sale or pre-mined tokens, and every BTC was mined by participants who joined the network on their own.

Pre-mined tokens are the opposite. In this model, a portion of tokens is created and distributed before the public gets access. This is often done to raise funds or reward early contributors. Ethereum followed this path, with about 60 million ETH sold in a pre-sale before its network went live.

Neither model is automatically better. A fair launch builds strong decentralization narratives and grassroots credibility. Pre-mining can help bootstrap development, but it comes with added responsibility. Projects with pre-mined tokens need transparent governance and clear incentives to build trust.

Fair launch: Strong decentralization message

Pre-mine: Needs clear governance, trust-building, and transparency

Token Allocation Models

A good allocation plan balances rewards with sustainability. Here’s how most projects break down token distribution:

- Founders and team: Should be rewarded for their work, but most of their tokens should vest over time to align with long-term success.

- Investors: VCs and angels provide funding and go-to-market support. Their liquidity should be limited early on to prevent short-term exits that hurt the community.

- Treasury or DAO reserve: These tokens fund operations, grants, R&D, and future growth. The treasury is key to long-term survival.

- Ecosystem grants: Set aside tokens for builders, integrations, and partnerships. This helps bootstrap usage and strengthen the network.

- Community incentives: Airdrops, staking rewards, referral bonuses, and liquidity mining all help distribute ownership and attract users.

A balanced allocation often looks like this:

- 20–25% for the team and advisors

- 15–20% for investors

- 20–30% for ecosystem and incentives

- 20–25% for the treasury

- 5–10% for public sale or community airdrops

Projects that give too much to insiders often face poor token distribution, weak community trust, and unstable prices after launch.

Vesting and Emission Schedules

Even with a good allocation, timing matters. Vesting and emission plans help prevent supply shocks and encourage long-term alignment.

Key elements include:

- Lockup periods: Tokens are held for a set time before they can be accessed (for example, 12 months).

- Cliffs: No tokens are released until after an initial period (like a 6-month cliff).

- Linear vesting: After the cliff, tokens unlock gradually (such as over the next 12 to 24 months).

A well-planned emission schedule sets expectations. Some projects, like Curve, front-load rewards to build early momentum. Others, like Bitcoin, use slower, long-term distribution with predictable halving events. No matter the model, the best practice is to publish a full token unlock timeline so the community and investors know what’s coming. Transparency here builds confidence.

Structured vesting: Supports healthy price action and aligned incentives

Instant unlocks: Risk of quick exits and market volatility

Aligning Incentives with Tokenomics

Tokenomics isn’t just about setting supply caps or choosing token types. At its core, tokenomics is about influencing behavior. A well-designed token motivates users, validators, builders, and investors to take actions that help grow and sustain the network. When incentives are structured thoughtfully, the community works alongside you, not just for quick profits, but to create lasting value.

Let’s look at how tokens can align incentives across key stakeholder groups.

Users

Users are the lifeblood of any ecosystem. Your token should give them clear reasons to stay engaged, not just to sell at the first opportunity.

Common ways to incentivize users include:

- Discounts: Holding or using the native token could reduce trading fees (like BNB on Binance) or give cheaper access to services.

- Staking rewards: Let users lock tokens and earn yield, turning passive holders into active participants.

- Access: Some platforms use tokens to unlock premium features, content, or governance rights. This makes holding the token valuable beyond price speculation.

The goal is to make holding and using your token feel worthwhile. If you’re designing token-powered user incentives, our DeFi tokenization services can help you tie utility to real value.

Validators and Miners

Validators and miners keep decentralized networks secure. Their incentives should encourage honest behavior and sustainable participation.

What works well:

- Consistent rewards: Block rewards or staking yields should fairly reflect the costs and risks validators take on.

- Aligned incentives: Validators should have something to lose if they act dishonestly. Slashing penalties or reputation systems help here.

- Scalability: As more validators join, rewards should adjust in a way that keeps the network decentralized. Features like delegation can help prevent centralization.

These incentive designs are especially important in proof-of-stake systems, where token holdings influence validation power.

Developers and Builders

Builders are the ones who expand the ecosystem. Tokens can help motivate them to contribute in meaningful, long-term ways.

Strong incentive approaches include:

- Ecosystem grants: Set aside tokens for funding dApps, tools, and integrations that add value.

- Token-based compensation: Pay core contributors in tokens, ideally with vesting schedules to align interests.

- Retroactive rewards: Fund projects that have already proven their impact, as seen with Optimism’s retroactive public goods funding.

Long-Term Investors

Long-term investors are more than just speculators. They provide liquidity, vote on proposals, and often stick with the project through good and bad markets.

Ways to align their incentives include:

- Governance rights: Give investors a say in how the protocol evolves, so they have a reason to care about long-term value.

- Liquidity provider rewards: Offer competitive returns to those who provide liquidity or otherwise support the ecosystem.

- Loyalty bonuses: Consider rewarding early or long-term holders who help stabilize the token through bear markets.

These strategies help keep your token’s demand steady and encourage investors to contribute beyond short-term price action.

A Real-World Example: Compound’s COMP Token

Compound offers a great case study in incentive design. The protocol rewarded both borrowers and suppliers with COMP tokens. Users didn’t just earn interest, they gained governance power. This design encouraged engagement, inspired developers to build around COMP, and helped drive long-term ecosystem growth. It shows how well-planned incentives can bootstrap a thriving on-chain economy.

Governance and Decision-Making in Token Economies

Tokenomics without governance is like trying to sail without steering. In any decentralized ecosystem, governance determines how decisions are made, from protocol upgrades to managing the treasury. Strong governance helps prevent power from becoming too concentrated. It keeps decisions transparent and supports long-term alignment between the protocol and its community.

Let’s break down the main components of token-based governance and how they shape a project’s resilience.

On-Chain vs Off-Chain Governance

Governance happens at two levels: on-chain and off-chain. Both play important roles in making sure decisions are fair and effective.

- On-chain governance uses smart contracts to let token holders vote directly on proposals. Tools like Snapshot make voting transparent and verifiable. Many DAOs (Decentralized Autonomous Organizations) rely on on-chain mechanisms to automate upgrades, allocate funds, or approve new features.

- Off-chain governance happens through community discussions, forums, GitHub, and regular calls. These conversations don’t trigger direct changes, but they help refine proposals and build consensus before votes happen.

Most successful ecosystems blend the two. Off-chain discussions shape ideas and surface risks, while on-chain tools handle the final decision-making and execution. If you’re designing governance for your project, our blockchain services can help structure both layers for your community’s needs.

Voting Power Models

The voting system you choose defines how influence is distributed. Each model has trade-offs:

- 1 token = 1 vote: The simplest system, but it can lead to whales dominating decisions and discouraging smaller holders.

- Quadratic voting: This model gives smaller holders a bigger voice. The cost of casting more votes rises exponentially, so it’s harder for one entity to dominate.

- Delegated voting: Used in protocols like AAVE and Compound. Token holders can delegate their voting power to trusted representatives. This keeps decision-making efficient while preserving decentralization.

Choosing the right voting structure means thinking about your token distribution, the size of your community, and how complex your upgrade process is. The goal is to encourage participation without overwhelming users with too many decisions.

Treasury Management and Proposal Processes

A protocol’s treasury is its financial backbone. It funds development, audits, grants, marketing, and more. Without clear rules, though, the treasury can become a source of waste or even abuse.

Good practices include:

- Using DAO treasuries that are controlled by token holders or elected stewards. These should be held in a mix of native tokens and stablecoins to balance risk.

- Defining how proposals are submitted, reviewed, and approved. Set clear thresholds for passing votes, and establish rules for how funds are released.

- Adding safeguards like spending caps, time delays before funds move, and multi-signature wallets to protect against governance attacks.

MakerDAO provides one of the best examples of structured governance. It uses formal processes for budgeting, risk assessment, and managing core units — a model that other projects can learn from.

A well-designed governance system doesn’t just help make decisions. It builds trust, attracts contributors, and helps your protocol stand the test of time.

Common Tokenomics Pitfalls to Avoid

Even the most promising crypto project can fall apart if its tokenomics don’t hold up in the real world. Token design isn’t just theory — it directly influences how people behave, how capital moves, and how much trust your project earns over time. Here are some of the biggest mistakes that can quietly undermine even the most innovative ideas.

Over-Allocation to Insiders

When founders, early investors, or core team members hold too much of the token supply, especially without meaningful lockups, it creates serious risks. This kind of setup often leads to sudden sell-offs, weakens community morale, and sends a message that short-term gains matter more than long-term health. Decentralization and fairness begin at the distribution stage. If you’re designing your token distribution, it’s worth checking out best practices from projects with strong community trust.

Misaligned Incentives

Many projects make the mistake of rewarding hype instead of meaningful participation. When tokenomics centers on flashy airdrops, unsustainable APYs, or quick flips, it draws in speculators who leave as soon as the rewards dry up. The goal should be to design incentives that drive genuine engagement — whether that’s staking, governance, or actual use of the product. The right incentives encourage users to stick around and contribute value.

Unsustainable Inflation

Inflation can help get a network off the ground. It can reward validators, encourage liquidity, and fund growth. But when inflation keeps going without a matching rise in utility or demand, it chips away at token value. To avoid this, inflation needs to come with meaningful sinks. Staking, token burns, or high-utility functions give people reasons to hold and use tokens rather than just sell.

Overcomplicated Mechanics

More complexity doesn’t always make for a smarter design. Some projects layer on burns, rebases, liquidity locks, dual-token models, and other mechanics without a clear reason. The result? Users can’t figure out how the token works or why it has value. Simplicity helps people understand, trust, and use your token. A clean design often outperforms one that tries to do too much.

Ignoring Regulation

In many places, token design crosses into securities law. If your token looks like an investment — meaning it promises profit, offers no real utility, and stays under tight central control — it could count as an unregistered security. That can bring legal trouble before the project even gets off the ground. It’s essential to get legal input early in the design process. If you’re unsure how to balance innovation with compliance, we can help align your design with regulatory best practices.

A Hard Lesson from Terra

The collapse of Terra’s LUNA token offers one of the clearest warnings in tokenomics. Terra tied LUNA’s value to UST, its algorithmic stablecoin. The system relied on constant demand for UST and ongoing trust in its mint-burn logic. When confidence cracked, both tokens collapsed. UST lost its peg, and LUNA hyperinflated to near zero. The takeaway is simple: tokenomics must reflect real market behavior, not just theoretical models.

Next, let’s look at how to build a robust tokenomics model — step by step — with a framework you can apply to your own project.

Tokenomics Design Framework (Step-by-Step Guide)

Designing tokenomics isn’t just about supply numbers or fancy models. It’s about building a system of incentives that helps your project create lasting value for everyone involved. Below is a simple step-by-step framework you can follow to go from a whiteboard idea to a sustainable token economy.

1. Define Your Ecosystem Goals

Start with clarity on what your ecosystem is trying to achieve. What behavior are you hoping to incentivize? What real-world problem are you solving?

For example:

- A DeFi protocol might want to bootstrap liquidity and attract long-term capital.

- A game could focus on rewarding players and encouraging item trading.

- A DAO may need to fund contributors while keeping governance decentralized.

Your tokenomics should match your project’s core goal — not simply copy what worked in another hype cycle.

2. Choose Your Token Type(s)

Select the right token category for your needs:

- Utility token: For access, transactions, or rewards

- Governance token: For voting power and proposal rights

- Security token: For raising capital (be sure to meet regulatory requirements)

- Stablecoin: For payments or as a store of value

- NFTs: For unique ownership, tiered access, or credentials

Some ecosystems use dual-token models — one for utility, one for governance. Just make sure each serves a clear purpose.

3. Define Utility and Demand Drivers

Ask yourself: Why would anyone want to hold or use your token? Strong demand comes from clear reasons to engage, such as:

- Access to valuable services or features

- Staking to earn rewards or secure the network

- Governance power to shape the protocol’s future

- Discounts or enhanced yields for loyal users

Without real utility, demand will fade. Your token needs to fit into the daily flow of your ecosystem.

4. Design the Supply and Inflation Model

Choose a supply model that matches your goals:

- Fixed supply: Like Bitcoin — scarcity supports value

- Inflationary: Ongoing issuance to reward validators or users

- Deflationary: Supply shrinks through burns or buybacks

- Elastic: Supply adjusts dynamically, often with algorithmic rules

Model how supply will change over time, and connect it to actual usage rather than just the passage of time.

5. Plan Distribution and Vesting

Break down your token allocation thoughtfully:

- Team and advisors

- Investors

- Treasury or DAO reserves

- Community incentives (staking, airdrops, liquidity mining)

Apply vesting schedules to prevent early dumps and align long-term interests. This might include cliffs, gradual unlocks, or emissions tied to user actions.

6. Align Incentives with Stakeholder Actions

Good tokenomics rewards behavior that strengthens the network:

- Users: Access benefits, loyalty rewards, or referral bonuses

- Developers: Ecosystem grants, retroactive rewards for valuable contributions

- Validators: Block rewards or staking yields

- Investors: Governance rights or long-term staking incentives

The goal is to build feedback loops that encourage real participation — not just speculation.

7. Outline Your Governance Structure

Decide how decisions will be made:

- Will governance happen on-chain, off-chain, or both?

- What voting model fits your community (1 token = 1 vote, delegated voting, quadratic voting)?

- Who can submit proposals?

- How will the treasury be managed?

Governance is what helps your protocol stay resilient and aligned as it grows. If you’re building this layer, our DAO development insights can be a helpful resource.

8. Test for Sustainability

No tokenomics model is finished at launch. Test your assumptions and be ready to adapt:

- Will demand grow faster than inflation?

- Are incentives balanced across user groups?

- What happens if token price drops — do your incentives still work?

Run simulations, gather community feedback, and plan for ongoing adjustments. Strong tokenomics evolves alongside your ecosystem.

FAQs About Tokenomics

Even the best-designed token model will raise questions — especially from builders figuring out their first project or investors trying to make sense of the mechanics. Here are answers to some of the most common ones.

What makes a good tokenomics model?

A strong tokenomics model aligns incentives with your ecosystem’s goals. It should create real utility for users, balance supply with demand, and distribute tokens in a way that feels fair. It also needs to evolve as the community grows and provides feedback. A good model encourages long-term participation rather than short-term speculation. Simplicity helps too. If people can’t understand how the token works, they’re less likely to trust or use it.

How do tokenomics affect token price?

Price reflects the balance of supply, demand, and speculation. A token model with high inflation and weak utility usually loses value over time. On the other hand, models that limit supply or introduce deflation (such as burns or lockups) can help support price — but only if demand exists. Incentives like staking, governance rights, or access to valuable features can boost demand by giving people reasons to hold the token rather than sell it.

Can a token work without utility?

Technically, yes. But in practice, tokens without clear utility don’t last. They become purely speculative assets. When the initial hype fades, the price often crashes because there’s no reason for people to keep holding. A token needs to serve a purpose — whether that’s providing access to services, enabling governance, offering staking rewards, or even acting as a cultural or community symbol.

How many tokens should I issue for my project?

There’s no universal answer. Some projects choose 21 million tokens, like Bitcoin. Others opt for a billion or more. The total supply matters less than how tokens are allocated, vested, and used. Focus on creating a model that feels intuitive for users and supports long-term value. You’ll want to avoid scenarios where a single token is priced so low that it feels meaningless or where the supply overwhelms demand.

How does token burning affect value?

Token burning permanently removes tokens from circulation, which can increase scarcity if demand holds steady or grows. This tactic is used in deflationary models to reward holders or show the protocol’s commitment to long-term value. Binance’s quarterly burns and Ethereum’s EIP-1559 are two well-known examples. But burning by itself doesn’t guarantee higher prices. The key is pairing it with demand drivers that make people want to hold and use the token.

Conclusion: Sustainable Tokenomics Is Product Design

Tokenomics is often mistaken for a tool to raise capital or drive short-term price gains. In reality, it’s much deeper than that. Tokenomics is product design for economic behavior. It shapes how value moves through your ecosystem, how people are motivated to contribute, and how trust is built and maintained over time.

A well-designed token does more than act as currency. It becomes the mechanism that keeps your community aligned. Good tokenomics balances growth, how fast your ecosystem scales; with utility, so people have real reasons to hold and use your token. It also supports governance by giving stakeholders a say in the future of the protocol. If any of these pieces are missing, the system becomes fragile. We’ve seen this happen in projects where hype and speculation outpaced real utility or sound design.

It’s important to remember that tokenomics isn’t something you design once and forget. Like your codebase or product features, your token model should evolve. What works in year one might need adjustments as your community grows and the market changes. The best projects keep iterating to stay relevant and resilient.

If you’re working on a Web3 project, don’t treat token design as an afterthought. It’s the economic engine that powers your protocol and deserves the same care as your product roadmap.

Take time to study successful examples. Look at how ETH, UNI, COMP, and AAVE created ecosystems that continue to thrive. Pay attention to what went wrong in projects like Terra, and let those lessons shape your thinking. Strong tokenomics doesn’t happen by chance. It’s built with intention, tested in the real world, and refined through community feedback.

Your token model can follow that same path.