How To Create A Secure Crypto Wallet?

- BLOG

- Crypto, Cryptocurrency Development

- April 10, 2025

Millions of users still lose funds by not understanding how to create a secure crypto wallet. Rushed setups, weak protection, and ignored recovery steps make wallets easy targets.

To build a secure crypto wallet, start with trusted software or hardware, protect your private keys offline, enable 2FA, and document your seed phrase properly.

This guide explains each step clearly so you can create crypto wallet solutions that are secure, user-friendly, and built to last.

Contents

- 1 What Is A Crypto Wallet?

- 2 Why Wallet Security Matters More in Crypto

- 3 How To Create A Secure Crypto Wallet?

- 4 Advanced Techniques for Securing Your Crypto Wallet

- 5 Additional Best Practices for Security In Crypto Wallet Development

- 6 In Closing

- 7 Frequently Asked Questions

- 7.1 1. What is the difference between hot wallets and cold wallets?

- 7.2 2. Can I use the same crypto wallet on multiple devices?

- 7.3 3. What happens if I lose my recovery phrase?

- 7.4 4. Are custodial wallets safe to use?

- 7.5 5. How do I verify that a crypto wallet app is legitimate?

- 7.6 6. How to make a Bitcoin wallet specifically?

What Is A Crypto Wallet?

A crypto wallet is a digital tool that securely stores your cryptographic keys, enabling safe transactions and efficient asset management. IIt doesn’t store the coins themselves, but rather the private keys that give you control over your assets on the blockchain.

These private keys are essential for authorizing transactions—without them, you can’t move or access your crypto.

A wallet’s primary job is to keep those keys safe while enabling you to send and receive funds securely.

The crypto wallet security directly impacts the safety of your assets. Losing your keys means losing access to your crypto permanently.

That’s why secure storage, careful backup of your recovery phrase, and strong authentication practices are critical.

Why Wallet Security Matters More in Crypto

In traditional finance, centralized institutions like banks are responsible for securing your funds, managing fraud protection, and offering recovery options. But in the world of cryptocurrency and blockchain, there is no central authority performing these roles.

This decentralization is a core strength of blockchain technology—but it also means that the responsibility for security partially shifts to the user. Without intermediaries, users must take a more active role in protecting their assets, especially through the use of secure wallets.

A secure crypto wallet doesn’t just enable transactions—it protects your private keys, guards against theft, and ensures long-term access to your funds. That’s why choosing a well-built wallet is essential, and why the expertise behind the wallet matters just as much as its features.

If you’re looking to create a wallet that puts security first, partner with our expert wallet development team and build with confidence

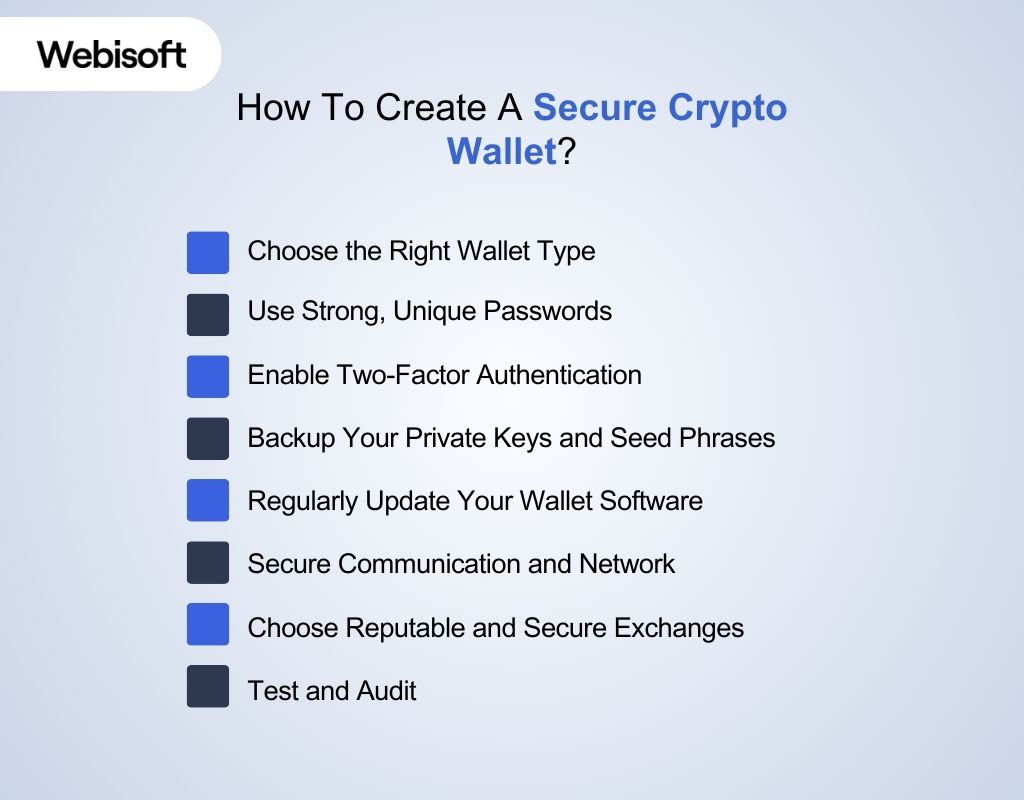

How To Create A Secure Crypto Wallet?

Creating a secure software crypto wallet involves clear, practical steps to protect your digital assets effectively.

This guide covers the critical details of wallet setup, highlighting essential security measures to ensure your cryptocurrency remains protected.

Choose the Right Wallet Type

The first step is to decide what kind of wallet fits your needs. Software wallets come in different forms. Some are “hot” wallets connected to the internet for convenience, while others are “cold” wallets that keep keys offline for security.

If you plan to use your wallet frequently, a hot wallet might be suitable, but understand it carries more risk from online attacks. For long-term storage or large amounts, cold wallets or hardware wallets are safer options.

Also, consider if you want a custodial wallet, where a third party holds your keys, or a non-custodial one, where you control your keys yourself.

Use Strong, Unique Passwords

Once you have your wallet, protecting it starts with a strong password. Avoid common or reused passwords

Instead, create a unique combination of letters, numbers, and symbols that only you know.

This password is the first line of defense against unauthorized access. Many wallet breaches happen because users pick weak or predictable passwords.

Treat your wallet password like a key to a safe- if someone guesses it, they can steal your assets.

Use a reliable password manager if you struggle to remember complex passwords, but never store passwords in plain text or unsecured places.

Enable Two-Factor Authentication (2FA)

Adding two-factor authentication (2FA) significantly boosts your wallet’s security.

With 2FA, even if someone steals your password, they still need a second form of verification, like a code from your phone or a biometric scan, to access your wallet.

This extra step makes unauthorized access much harder. Many wallets and exchanges offer 2FA options- always enable it. It’s a simple but powerful way to protect your assets from hackers who might have obtained your password through phishing or leaks.

Backup Your Private Keys and Seed Phrases

Your private keys or seed phrases are the master keys to your wallet. Losing them means losing access to your funds forever. Therefore, backing them up securely is crucial.

Write your seed phrase on paper and store it in a safe, offline location- never save it digitally where it can be hacked or stolen. Consider keeping multiple copies in different secure places to protect against loss from fire or theft.

Remember, anyone with access to your seed phrase can control your wallet, so treat it with the utmost care.

Regularly Update Your Wallet Software

Wallet developers regularly release updates to fix security vulnerabilities and improve features. Keeping your wallet software up to date is essential to protect against new threats.

Ignoring updates can leave your wallet exposed to known exploits that hackers actively use.

For instance, in 2024 alone, approximately $2.2 billion worth of cryptocurrency was stolen through hacks, with private key compromises accounting for 43.8% of these thefts

Secure Communication and Network

When you use your wallet, ensure the communication between your device and the blockchain or exchange is encrypted. This means using secure internet connections (like HTTPS) and avoiding public Wi-Fi networks that hackers can monitor.

If possible, use a VPN to add another layer of protection. Wallet apps should also implement security features like certificate pinning to prevent man-in-the-middle attacks, where attackers intercept your data.

Choose Reputable and Secure Exchanges

If you use exchanges to buy or sell cryptocurrencies, pick ones with strong security reputations. Reputable exchanges invest heavily in protecting user funds through cold storage, insurance, and regular security audits.

Avoid lesser-known or unregulated platforms that might be vulnerable to hacks or fraud. Your wallet’s security can be compromised if the exchange you rely on is breached, so always research and choose carefully.

Test and Audit

Finally, if you are developing or managing a wallet, continuous testing and auditing are vital. Security audits by independent experts help find vulnerabilities before attackers do.

Regular code reviews, penetration testing, and using automated tools to scan for weaknesses ensure your wallet stays secure as threats evolve. For users, choosing wallets that undergo such audits adds confidence that the software is trustworthy and well-maintained.

Advanced Techniques for Securing Your Crypto Wallet

Store Cryptocurrency in Cold Wallets

Cold wallets keep your private keys completely offline, which greatly reduces the risk of hacking or malware attacks. By storing your keys on a hardware device or even on paper, you remove them from internet-connected environments where most attacks occur.

This makes cold wallets ideal for long-term storage or holding large amounts of cryptocurrency.

Hardware Security Modules (HSMs)

HSMs are specialized devices designed to securely generate and store cryptographic keys in a tamper-proof environment. They perform sensitive operations like signing transactions internally, so private keys never leave the device.

This means even if your computer or network is compromised, the keys remain protected inside the HSM. These modules are widely used by institutions and exchanges because they offer a high level of security against both physical and cyber threats.

Decentralized Options (DEXs/P2P)

Decentralized exchanges (DEXs) and peer-to-peer (P2P) platforms let you trade cryptocurrencies directly without relying on a central authority. This reduces the risk of losing funds due to exchange hacks or regulatory issues.

Using decentralized options means you keep control of your private keys and funds at all times, which enhances security.

Use Multi-Signature or Multi-Party Computation (MPC)

Multi-signature wallets require multiple approvals before a transaction can be executed, spreading control across several keys or parties.

This prevents a single compromised key from allowing unauthorized transfers. Multi-party computation (MPC) takes this further by enabling multiple participants to jointly sign transactions without exposing their private keys to each other.

Implement Multi-Layered Cybersecurity Measures

Protecting your crypto wallet means using several layers of security. Hardware wallets keep your private keys offline, which greatly reduces online risks.

However, in 2023, researchers found a vulnerability in the Trezor Model T that could expose keys-but only if an attacker has physical access and special tools. Using both a PIN and a strong passphrase helps prevent this kind of attack.

Additional Best Practices for Security In Crypto Wallet Development

Building a secure crypto wallet requires careful planning and precise execution.

Implementing these detailed best practices can significantly enhance wallet security, reliability, and user trust.

i) Choose The Right Technology Stack

The technology stack you select directly affects your wallet’s security and scalability. Use reputable blockchain platforms and widely-supported frameworks, such as Ethereum-compatible tools (e.g., Web3.js or ethers.js).

Incorporate proven cryptographic libraries that have active developer communities and regular security patches. Avoid untested technologies, as these increase vulnerabilities and complicate future maintenance.

ii) Use Secure Code Practices

Secure code practices minimize vulnerabilities in your wallet’s software. Adopt recognized secure coding standards, such as the OWASP Top Ten security guidelines, to prevent common web-application exploits.

Conduct thorough peer code reviews, ensuring multiple developers examine the code critically.

Integrate automated static code analysis tools to identify potential vulnerabilities during the development process.

iii) Compliance And Regulatory Standards

Compliance with global and regional regulations is critical for wallet acceptance and trust.

Clearly implement procedures adhering to regulations like Know Your Customer (KYC) verification, Anti-Money Laundering (AML), and GDPR (data privacy) laws.

Develop processes for secure and transparent handling of sensitive user information, minimizing privacy risks.

iv) User Experience And Interface (UX/UI)

A carefully designed, intuitive user interface significantly reduces the likelihood of user errors, boosting overall wallet security.

Provide clear instructions and guidance for transactions, wallet setup, security features, and backup methods.

Avoid complicated navigation or unclear messaging, as these can lead to mistakes or loss of assets.

In Closing

Securing your crypto begins with the right foundation—clear setup, strong private key protection, and reliable wallet technology.

As the landscape evolves in 2025, building a secure crypto wallet isn’t just about holding assets—it’s about long-term resilience, privacy, and control.

Whether you’re developing a wallet or managing your own, expert guidance makes all the difference.

If you’re planning to build a crypto platform with secure wallet functionality, partner with Webisoft.

Their proven experience in blockchain, smart contracts, and wallet development ensures your solution is built right, from codebase to compliance.

Frequently Asked Questions

1. What is the difference between hot wallets and cold wallets?

Hot wallets are connected to the internet and used for frequent transactions. Cold wallets, like hardware wallets, stay offline and offer higher security for long-term storage.

2. Can I use the same crypto wallet on multiple devices?

Yes, but only if the wallet supports multi-device syncing. You must import your wallet using the recovery phrase, and always enable security features on each device.

3. What happens if I lose my recovery phrase?

If you lose your recovery phrase, you can’t recover your wallet or access your funds. Always store it offline, in multiple secure locations.

4. Are custodial wallets safe to use?

Custodial wallets can be safe if managed by reputable providers, but you are relying on a third party. You don’t control the private keys, which increases dependency risks.

5. How do I verify that a crypto wallet app is legitimate?

Download only from official websites or app stores, check developer credentials, and review audits or security history. Avoid clones or links from unknown sources.

6. How to make a Bitcoin wallet specifically?

To make a Bitcoin wallet, choose a wallet app that supports Bitcoin, install it, and generate a secure recovery phrase. Always store your private keys offline.