DeFi (Decentralized Finance) staking is an exciting way to earn rewards with your cryptocurrency. Simply put, it means locking your digital assets into a blockchain network. In return, you get rewards, like earning interest in a savings account.

But here’s the exciting part — there’s no middleman involved. No banks, no brokers, just you and the blockchain. And guess what? It’s available to anyone with an internet connection and some crypto assets.

Now, you might be wondering, how does it actually work? Well, your assets are added to something called a staking pool. These pools help blockchain networks stay secure and run smoothly. In exchange, you earn rewards in the form of tokens.

The best thing about DeFi staking is its simplicity. Thanks to smart contracts, everything runs automatically and transparently. No hidden fees, no unnecessary steps.

But wait, there’s more! DeFi staking isn’t just about earning rewards — it’s about being part of something bigger. You’re helping power a decentralized financial system.

Platforms like Binance Staking make this process even easier by offering user-friendly interfaces and a wide range of staking options, allowing you to earn rewards effortlessly while contributing to blockchain networks.

Anyway, in this guide, we’ll break down everything you need to know. From how staking works to how you can start earning. So, let’s dive in and explore the exciting world of DeFi staking together!

Contents

- 1 What is DeFi Staking?

- 2 Types of DeFi Staking

- 3 How Does DeFi Staking Work?

- 3.1 Step 1: Choose a DeFi Staking Platform

- 3.2 Step 2: Set Up a Crypto Wallet

- 3.3 Step 3: Connect Wallet to the Staking Platform

- 3.4 Step 4: Choose the Staking Pool

- 3.5 Step 5: Stake Your Tokens

- 3.6 Step 6: Validation and Network Contribution

- 3.7 Step 7: Earn Staking Rewards

- 3.8 Step 8: Monitor Your Staking Performance

- 3.9 Step 9: Withdraw Your Tokens and Rewards

- 4 DeFi Earning Opportunities

- 4.1 Earn Passive Rewards Through DeFi Token Staking

- 4.2 Boost Your Earnings with Yield Farming Strategies

- 4.3 Get Paid for Providing Liquidity on DEXs (Liquidity Mining)

- 4.4 Earn Interest by Lending Your Crypto Assets

- 4.5 Stake Governance Tokens and Have a Say in Projects

- 4.6 Join DAOs and Earn Participation Rewards

- 5 Pros & Cons of DeFi Staking

- 6 Top 10 DeFi Staking Platforms

- 7 Earning Passive Income With DeFi Staking: A 4-Step Process

- 8 How to Stake DeFi Coins

- 8.1 Step 1: Choose the Right DeFi Coin and Staking Platform

- 8.2 Step 2: Set Up a Compatible Crypto Wallet

- 8.3 Step 3: Connect Your Wallet to the Staking Platform

- 8.4 Step 4: Choose a Staking Pool or Validator

- 8.5 Step 5: Stake Your Coins

- 8.6 Step 6: Monitor Your Staking Dashboard

- 8.7 Step 7: Claim or Reinvest Your Rewards

- 9 How to Build a DeFi Staking Platform

- 9.1 Step 1: Define Your Platform’s Goals and Features

- 9.2 Step 2: Choose the Right Blockchain Network

- 9.3 Step 3: Design the Platform Architecture

- 9.4 Step 4: Develop Smart Contracts

- 9.5 Step 5: Integrate Wallet Support

- 9.6 Step 6: Build a User Dashboard

- 9.7 Step 7: Implement Security Protocols

- 9.8 Step 8: Test the Platform Thoroughly

- 9.9 Step 9: Launch and Market the Platform

- 9.10 Step 10: Provide Ongoing Support and Upgrades

- 10 Key Elements of DeFi Staking Development Services

- 11 Technical Architecture of a DeFi Staking Platform

- 12 Security Challenges in DeFi Staking

- 13 Regulatory Considerations for DeFi Staking Platforms

- 14 The Future of DeFi Staking

- 15 Real-World Case Studies of Successful DeFi Staking Platforms

- 16 Webisoft: Your Trusted Partner for DeFi Staking Platform Development

- 17 Conclusion

- 18 Frequently Asked Questions [FAQs]

- 18.1 1. How can I start staking my crypto assets?

- 18.2 2. What happens if I want to withdraw my staked tokens early?

- 18.3 3. How much can I earn through DeFi staking?

- 18.4 4. Is my staked crypto safe?

- 18.5 5. Do I need technical knowledge to stake my crypto?

- 18.6 6. What are the main differences between DeFi staking and traditional finance savings accounts?

- 18.7 7. Are staking rewards considered taxable income?

What is DeFi Staking?

DeFi (Decentralized Finance) staking is the process of locking your cryptocurrency into a blockchain network to support its operations, such as transaction validation and network security. In return, you earn rewards, usually in the form of extra tokens.

Think of it like putting your money into a savings account, but instead of a bank, you’re trusting a decentralized blockchain system. Here, smart contracts — automated digital agreements written in code — handle everything transparently and securely.

At its core, DeFi staking is built on Proof-of-Stake (PoS) or similar blockchain mechanisms. These systems rely on staked assets to keep the network functional, efficient, and secure.

But what is DeFi staking, really? It’s an innovative financial model that allows anyone with crypto assets and an internet connection to participate. There’s no need for middlemen, and everything operates transparently on the blockchain.

In short, DeFi staking is a decentralized way to grow your digital assets while playing an active role in securing and supporting blockchain networks. It’s both a financial opportunity and a step into the future of finance.

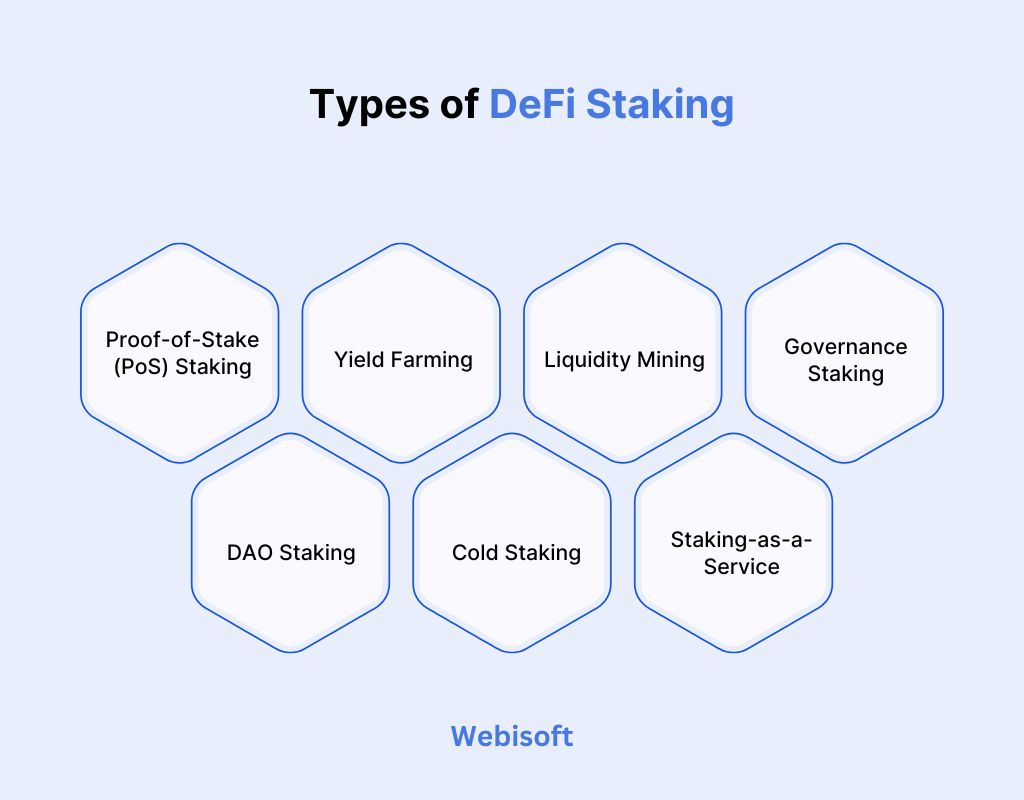

Types of DeFi Staking

DeFi staking comes in different shapes and sizes, each offering something unique. Whether you’re securing a network, earning rewards, or having a say in governance, there’s a staking type for you.

But here’s the exciting part — every type has its own purpose, rewards, and risks. Understanding the types of DeFi staking can help you choose the right approach based on your goals and risk tolerance.

Let’s explore them one by one, step by step.

Proof-of-Stake (PoS) Staking

Proof-of-Stake (PoS) staking is one of the most common methods in DeFi. Simply put, you lock your crypto assets to help validate blockchain transactions. And here’s the best part — the network rewards you with extra tokens in return.

- Main Goal: Help validate blockchain transactions.

- Rewards: Earn additional tokens as a reward.

- Risk Level: Moderate (depends on the network’s reliability).

- Best For: Long-term crypto holders.

And the good news? You don’t need advanced technical skills to start. Most platforms make it super easy.

Yield Farming

Yield farming is like planting seeds in different fields to get the best harvest. In simple terms, you stake or lend your crypto to DeFi protocols to earn maximum rewards. But here’s the catch — it involves moving assets frequently to chase higher returns.

- Main Goal: Maximize earnings through high-yield pools.

- Rewards: Earn interest and governance tokens.

- Risk Level: High (due to price fluctuations).

- Best For: Experienced investors who love chasing opportunities.

Sounds exciting, right? But remember, high rewards often come with high risks.

Liquidity Mining

Liquidity mining is all about helping decentralized exchanges (DEXs) run smoothly. You provide liquidity to trading pairs, and in return, you earn rewards. And here’s the cool part — you also earn a share of trading fees.

- Main Goal: Provide liquidity for trading pairs.

- Rewards: Earn transaction fees and tokens.

- Risk Level: High (risk of impermanent loss).

- Best For: Users with spare crypto assets.

It’s a win-win — the platform gets liquidity, and you get rewards.

Governance Staking

Governance staking is all about having a voice in a DeFi project. When you stake your tokens, you earn voting rights. And that means you can help decide on important updates or changes in the protocol.

- Main Goal: Participate in decision-making.

- Rewards: Voting power and sometimes token incentives.

- Risk Level: Low to moderate.

- Best For: Community-focused investors.

The best part? Your opinion truly matters in shaping the project’s future.

DAO Staking

DAO staking takes community involvement to the next level. You stake your assets in a Decentralized Autonomous Organization (DAO) to support its treasury and governance. And guess what? You often earn rewards while helping drive important decisions.

- Main Goal: Support DAO operations and governance.

- Rewards: Voting power and profit-sharing opportunities.

- Risk Level: Moderate (depends on DAO stability).

- Best For: Investors passionate about community-driven projects.

It’s not just staking — it’s about being part of something bigger.

Cold Staking

Cold staking is perfect for those who value security above all. It involves staking your assets using offline wallets. And here’s the good news — your funds stay safe from online risks.

- Main Goal: Keep assets secure while staking.

- Rewards: Earn passive rewards safely.

- Risk Level: Low (high security).

- Best For: Long-term holders focused on safety.

It’s like putting your crypto in a high-security vault while it earns rewards.

Staking-as-a-Service (SaaS)

Staking-as-a-Service makes staking super easy for everyone. You don’t need to handle technical details or maintain complex setups. The platform does everything for you, and you simply earn rewards.

- Main Goal: Make staking simple for beginners.

- Rewards: Earn passive income effortlessly.

- Risk Level: Moderate (platform reliability matters).

- Best For: Beginners and non-technical users.

It’s like having someone else do the hard work while you enjoy the benefits.

How Does DeFi Staking Work?

DeFi staking might seem complex at first, but it becomes much clearer when broken into smaller steps. At its core, it’s about locking your cryptocurrency into a blockchain network to earn rewards while supporting the network’s operations. Let’s simplify the entire process into detailed, easy-to-follow steps.

Step 1: Choose a DeFi Staking Platform

The first and most important step is selecting a trustworthy platform or blockchain network. Your choice will determine your staking rewards, risks, and overall experience.

- Research Different Platforms: Look into popular options like Ethereum 2.0, Cardano, or DeFi protocols like Aave and PancakeSwap.

- Check Reward Rates: Different platforms offer different reward percentages. Compare these before deciding.

- Review Security Measures: Ensure the platform has strong security protocols and a good track record.

- Evaluate Staking Terms: Look at lock-up periods, withdrawal flexibility, and associated fees.

Example: Alice chooses Ethereum 2.0 because of its strong reputation and reliable defi staking rewards.

Step 2: Set Up a Crypto Wallet

Next, you need a digital wallet to hold and stake your cryptocurrency. This wallet will also connect you to the staking platform.

- Choose a Compatible Wallet: Popular options include MetaMask, Trust Wallet, and Ledger (hardware wallet).

- Secure Your Wallet: Use strong passwords and back up your seed phrase securely.

- Transfer Cryptocurrency: Move your tokens from an exchange or another wallet into your staking wallet.

Example: Alice sets up her MetaMask wallet, backs up her seed phrase, and transfers her ETH tokens to it.

Step 3: Connect Wallet to the Staking Platform

Your wallet must now be linked to the staking platform. This step allows you to interact with the blockchain protocol seamlessly.

- Visit the Staking Platform Website: Always double-check the URL to avoid phishing sites.

- Click on “Connect Wallet”: Select your wallet provider (e.g., MetaMask).

- Authorize the Connection: Confirm the connection in your wallet interface.

Example: Alice visits the Ethereum 2.0 staking portal, clicks on “Connect Wallet,” and authorizes her MetaMask wallet.

Step 4: Choose the Staking Pool

Most staking platforms allow you to stake individually or join a staking pool. Pools combine multiple users’ assets for better efficiency and rewards.

When exploring the best crypto staking platforms, it’s important to compare factors like security, reward rates, fees, and ease of use. Choosing the right platform can significantly impact your staking experience and overall returns.

- Understand Pool Dynamics: Different pools have varying fees, reward rates, and lock-up requirements.

- Choose the Right Pool: Pick a well-established pool with high uptime and a good reputation.

- Check Pool Fees: Some pools deduct a small percentage from your rewards as commission.

Example: Alice selects a popular staking pool on Ethereum 2.0, known for consistent uptime and fair fees.

Step 5: Stake Your Tokens

This is where you officially lock your cryptocurrency into the network.

- Enter the Staking Amount: Choose how many tokens you want to stake.

- Review Staking Terms: Check the lock-up duration, minimum staking amount, and reward frequency.

- Confirm the Transaction: Approve the staking transaction in your wallet.

Example: Alice stakes 5 ETH into her selected Ethereum 2.0 pool and confirms the transaction in her MetaMask wallet.

Step 6: Validation and Network Contribution

Once your tokens are staked, they become part of the network’s validation process. This helps ensure blockchain transactions are secure and accurate.

- How It Works: Validators use staked tokens to verify and process transactions.

- Your Contribution Matters: The more tokens staked, the more stable and secure the network becomes.

- Automatic Process: Everything happens automatically through smart contracts.

Example: Alice’s staked ETH helps validate transactions on the Ethereum network, contributing to its security and efficiency.

Step 7: Earn Staking Rewards

This is the part everyone loves — earning rewards!

- Rewards Calculation: Rewards are usually based on the number of tokens staked and the duration of staking.

- Reward Frequency: Some platforms distribute rewards daily, weekly, or monthly.

- Automatic Distribution: Rewards are sent directly to your wallet or staking account.

Example: Alice earns 0.1 ETH weekly from her staked assets.

Step 8: Monitor Your Staking Performance

It’s important to keep track of your staked assets and rewards.

- Check Dashboard: Most platforms have a dashboard showing your staked amount, rewards, and earnings history.

- Stay Updated: Monitor any changes in staking fees or platform policies.

- Adjust If Needed: Some platforms allow you to add or remove assets from the staking pool.

Example: Alice checks her staking dashboard weekly to see her earned rewards and network performance.

Step 9: Withdraw Your Tokens and Rewards

When the staking period ends, or if the platform allows flexible staking, you can withdraw your tokens and earn rewards.

- Review Withdrawal Terms: Some platforms have a waiting period for unstaking tokens.

- Pay Attention to Fees: Early withdrawals might come with penalties.

- Confirm Withdrawal: Approve the withdrawal transaction in your wallet.

Example: After 6 months, Alice withdraws her 5 ETH plus her earned 1 ETH in rewards.

DeFi Earning Opportunities

DeFi (Decentralized Finance) has completely changed the way people earn money with cryptocurrency. It’s no longer just about buying and holding tokens, hoping their value goes up. Now, you can actively grow your assets using different strategies. The best part? Many of these methods let your money work for you while you relax.

But wait, there’s more! Each earning method has its own style, risk level, and rewards. Some are beginner-friendly, while others need a bit more experience.

In the world of defi earn, you’ll find a variety of opportunities to maximize your cryptocurrency holdings. From staking and yield farming to liquidity providing, each method offers unique ways to generate defi passive income.

Let’s break them down in simple, practical, and easy-to-follow ways.

Earn Passive Rewards Through DeFi Token Staking

DeFi token staking is one of the easiest ways to earn rewards. Think of it like putting your money in a savings account, but instead of a bank, you’re using a blockchain network.

When you stake your tokens, you’re locking them into the network. Why? Because this helps validate transactions and keeps the blockchain secure. In return for your contribution, the network rewards you with more tokens.

How it works:

- Choose a blockchain or DeFi platform (e.g., Ethereum, Cardano).

- Lock your tokens into a staking pool.

- Validators use your tokens to verify transactions.

- You earn rewards, usually in the same token you staked.

Why it’s great: It’s low effort and fairly safe if you choose a reputable platform. Plus, your tokens are still yours — they’re just locked for a while.

It’s perfect for beginners who want a steady, reliable way to earn extra crypto.

Boost Your Earnings with Yield Farming Strategies

Yield farming is like being a digital farmer, but instead of crops, you’re growing tokens. The idea is to move your crypto assets between different DeFi protocols to maximize your rewards.

It works by lending or staking your tokens in liquidity pools. These pools are used to power lending, borrowing, or trading on DeFi platforms. In return, you earn rewards, often in the form of interest or extra tokens.

How it works:

- Choose a DeFi protocol offering yield farming (e.g., Aave, Compound).

- Deposit your tokens into a high-yield pool.

- The protocol uses your tokens for lending or trading.

- You earn rewards from fees or interest generated by the pool.

Why it’s exciting: The returns can be much higher than traditional staking. But here’s the catch — it can also be riskier due to price fluctuations and complex strategies.

It’s great for people who like to stay active with their investments and aren’t afraid of a little risk.

Get Paid for Providing Liquidity on DEXs (Liquidity Mining)

Liquidity mining is all about helping decentralized exchanges (DEXs) work smoothly. These platforms, like Uniswap or PancakeSwap, need liquidity (available tokens) to enable trading.

When you provide liquidity by depositing tokens into a liquidity pool, you earn rewards. These rewards usually come from transaction fees or special liquidity provider (LP) tokens.

How it works:

- Choose a trading pair (e.g., ETH/USDC) on a DEX.

- Deposit both tokens into the liquidity pool.

- Traders use the pool to exchange tokens.

- You earn a share of the transaction fees.

Why it’s rewarding: You’re directly supporting the DeFi ecosystem while earning a share of the profits.

But be cautious — there’s something called impermanent loss, which can happen if token prices fluctuate a lot.

It’s a good fit for users who already hold multiple crypto assets and want to put them to work.

Earn Interest by Lending Your Crypto Assets

Crypto lending is one of the easiest ways to earn passive income in DeFi. It’s like being your own bank — you lend your tokens to others and earn interest in return.

Platforms like Aave or Compound make this super simple. Borrowers take out loans by providing collateral, and lenders (like you) earn interest on the tokens they lend.

How it works:

- Deposit your tokens into a lending protocol.

- Borrowers take loans against their collateral.

- Interest is paid back to the lending pool.

- You receive your share of the interest.

Why it’s appealing: It’s low effort and offers steady returns. Plus, lending platforms often have built-in safety measures to protect your assets.

It’s a fantastic choice for those who want consistent returns without too much hassle.

Stake Governance Tokens and Have a Say in Projects

Governance staking isn’t just about earning — it’s about having a voice. When you stake governance tokens, you get voting rights in important decisions for a blockchain project or protocol.

These decisions could include things like protocol updates, reward structures, or new feature rollouts. In many cases, you also earn rewards for staking these tokens.

How it works:

- Stake governance tokens on the platform.

- Participate in protocol votes and decision-making.

- Earn rewards, sometimes in the form of extra tokens.

Why it’s powerful: You’re not just an investor; you’re part of the team shaping the future of the project.

It’s perfect for users who want both financial returns and a voice in a project’s direction.

Join DAOs and Earn Participation Rewards

DAOs (Decentralized Autonomous Organizations) are like online communities with shared goals, managed through blockchain technology. When you stake tokens or contribute to a DAO, you often earn rewards while playing a role in decision-making.

These rewards can be financial, like tokens, or non-financial, like exclusive access to certain services.

How it works:

- Join a DAO by holding its governance tokens.

- Participate in discussions, proposals, and votes.

- Earn rewards for your contribution.

Why it’s special: DAOs combine financial incentives with community-driven goals. It feels more personal because you’re directly contributing to something meaningful.

It’s great for those who enjoy being part of collaborative projects while earning along the way.

Pros & Cons of DeFi Staking

DeFi staking is an exciting way to earn passive income, but like any financial strategy, it comes with both advantages and disadvantages. Understanding both sides will help you make informed decisions and avoid unnecessary risks. Let’s break it down simply:

Pros of DeFi Staking

Passive Income Opportunities:

- Earn rewards simply by locking your tokens.

- It’s an easy way to make your assets work for you.

Network Security Contribution:

- Staking helps secure blockchain networks.

- Your tokens actively contribute to the network’s health.

Higher Returns Compared to Traditional Finance:

- Staking rewards are often higher than bank savings interest.

- Especially true on high-yield protocols.

Decentralized Control:

- No middlemen or third parties.

- You have full ownership of your staked assets.

User-Friendly Platforms:

- Many platforms are beginner-friendly.

- Clear dashboards and automated reward systems.

Additional Incentives:

- Some platforms offer bonus tokens or governance rights.

- Stakeholders can influence key decisions in protocols.

Cons of DeFi Staking

Lock-Up Periods:

- Tokens are often locked for a fixed period.

- Limited flexibility if you need quick access to funds.

Price Volatility:

- Crypto prices can drop significantly during the staking period.

- Your rewards may not always cover these losses.

Impermanent Loss (in Liquidity Staking):

- Token value fluctuations can reduce overall returns.

- Especially common in liquidity mining pools.

Technical Risks:

- Bugs or vulnerabilities in smart contracts can cause losses.

- Always research platform security.

Regulatory Uncertainty:

- Some governments are still figuring out DeFi regulations.

- Regulatory changes could affect your staking rewards.

Platform Reliability:

- Not all platforms are trustworthy.

- Scams and rug pulls are still a risk in the DeFi space.

Top 10 DeFi Staking Platforms

Choosing the right platform for DeFi staking is crucial for maximizing rewards and minimizing risks. Each platform has its own unique features, reward structures, and supported assets. Below are the top 10 best DeFi staking platforms known for their reliability, user-friendliness, and competitive rewards.

| Platform | Blockchain | Staking Mechanism | Key Feature | Best For |

| Ethereum 2.0 | Ethereum | Proof-of-Stake (PoS) | Network security and native ETH rewards | Long-term stakers seeking stability |

| Binance Smart Chain (BSC) | Binance Smart Chain | Delegated Proof-of-Stake (DPoS) | High-speed transactions with low fees | Beginners looking for easy staking options |

| Cardano (ADA) | Cardano | Proof-of-Stake (PoS) | Environmentally friendly staking with predictable rewards | Environmentally conscious investors |

| Solana (SOL) | Solana | Proof-of-Stake (PoS) | Ultra-fast transactions and low fees | Users seeking high-speed blockchain networks |

| Polkadot (DOT) | Polkadot | Nominated Proof-of-Stake (NPoS) | Cross-chain communication and scalability | Investors looking for interoperability-focused staking |

| Avalanche (AVAX) | Avalanche | Proof-of-Stake (PoS) | Fast transaction finality and low fees | Users interested in speed and scalability |

| Tezos (XTZ) | Tezos | Liquid Proof-of-Stake (LPoS) | On-chain governance and self-upgradable blockchain | Users who want governance participation |

| Cosmos (ATOM) | Cosmos | Proof-of-Stake (PoS) | Focus on interoperability and cross-chain transactions | Users interested in multi-chain ecosystems |

| PancakeSwap (CAKE) | Binance Smart Chain | Yield Farming and Liquidity Pools | Flexible and fixed staking options | Users looking for DeFi liquidity rewards |

| Aave (AAVE) | Multi-Chain | Lending and Borrowing Protocol | Staking and earning interest through lending pools | Users who prefer lending-based staking |

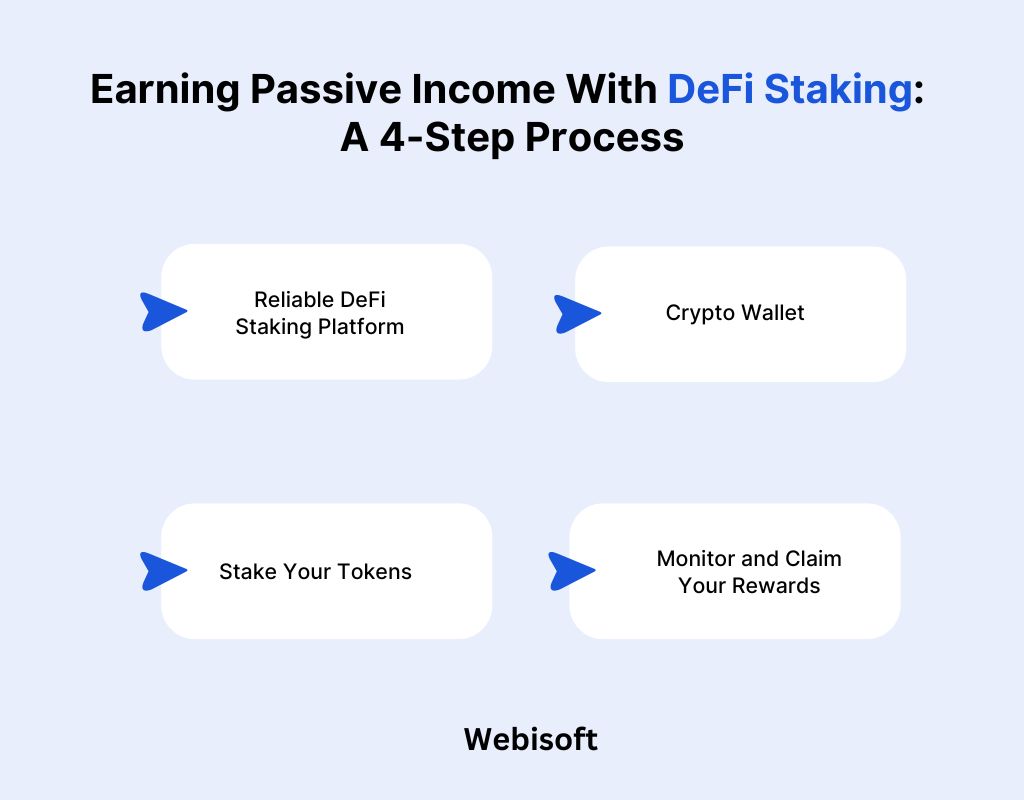

Earning Passive Income With DeFi Staking: A 4-Step Process

Earning passive income through DeFi staking doesn’t have to be complicated. It’s a simple, step-by-step process that anyone can follow. Whether you’re new to crypto or an experienced user, these four steps will guide you to start earning rewards efficiently. Let’s break it down into easy, practical steps.

Step 1: Choose a Reliable DeFi Staking Platform

Before anything else, you need a trustworthy platform to stake your crypto.

- Research Platforms: Look for platforms like Ethereum 2.0, Cardano, or Binance Smart Chain.

- Check Reward Rates: Compare Annual Percentage Yields (APY).

- Evaluate Security: Make sure the platform has been audited and has a good reputation.

- Review Lock-Up Terms: Understand how long your assets will be locked.

Example: Alice chooses Ethereum 2.0 for its stability and predictable rewards.

Step 2: Set Up and Fund Your Crypto Wallet

Next, you need a compatible crypto wallet to interact with the staking platform.

- Choose a Wallet: Popular options include MetaMask, Trust Wallet, or hardware wallets like Ledger.

- Transfer Your Tokens: Move your crypto assets from an exchange to your wallet.

- Ensure Compatibility: Make sure your wallet supports the chosen staking protocol.

Example: Alice sets up a MetaMask wallet, transfers her ETH tokens, and secures her wallet with a backup phrase.

Step 3: Stake Your Tokens

Now it’s time to lock your tokens and start earning rewards.

- Connect Your Wallet: Link your wallet to the staking platform.

- Select a Staking Pool: Choose a staking pool with good uptime and reasonable fees.

- Enter the Staking Amount: Decide how much crypto you want to stake.

- Confirm the Transaction: Approve the staking transaction in your wallet.

Example: Alice stakes 5 ETH into an Ethereum 2.0 staking pool and confirms the transaction.

Step 4: Monitor and Claim Your Rewards

Once your tokens are staked, rewards start rolling in.

- Track Your Staking Dashboard: Monitor your rewards and staking status.

- Understand Reward Frequency: Rewards may be distributed daily, weekly, or monthly.

- Withdraw Rewards: Depending on the platform, claim your earned tokens or let them compound.

- Stay Informed: Keep an eye on updates or changes in staking policies.

Example: Alice monitors her staking dashboard weekly and sees her rewards growing over time. After six months, she withdraws her 5 ETH plus 1 ETH in rewards.

How to Stake DeFi Coins

Staking DeFi coins is one of the easiest ways to earn passive income while contributing to the blockchain network’s security and performance. Whether you’re a beginner or an experienced user, the process is straightforward when broken down into clear steps. Let’s walk through it together.

Step 1: Choose the Right DeFi Coin and Staking Platform

The first step is selecting a cryptocurrency and a staking platform that fits your goals.

- Research Popular Coins: Look into options like ETH (Ethereum), ADA (Cardano), or DOT (Polkadot).

- Choose a Staking Platform: Options include Binance, PancakeSwap, or Aave.

- Check Reward Rates: Compare Annual Percentage Yields (APY) for each platform.

- Understand the Lock-Up Periods: Some platforms require you to lock tokens for weeks or months.

Example: Alice chooses Cardano (ADA) on a reliable staking platform with an attractive reward rate.

Step 2: Set Up a Compatible Crypto Wallet

To stake DeFi coins, you’ll need a wallet that supports the cryptocurrency you plan to stake.

- Choose a Wallet: Popular wallets include MetaMask, Trust Wallet, or Ledger (hardware wallet).

- Transfer Coins: Move your tokens from an exchange to your wallet.

- Secure Your Wallet: Set a strong password and back up your recovery phrase.

Example: Alice uses Trust Wallet to store her ADA tokens securely.

Step 3: Connect Your Wallet to the Staking Platform

Now you need to link your wallet to the staking platform.

- Visit the Staking Platform: Always ensure it’s the official website.

- Click ‘Connect Wallet’: Choose your wallet provider from the list.

- Authorize the Connection: Confirm the connection on your wallet interface.

Example: Alice connects her Trust Wallet to the Cardano Staking Platform securely.

Step 4: Choose a Staking Pool or Validator

In most DeFi staking systems, you’ll need to join a staking pool or select a validator node.

- Check Pool Performance: Look for pools with high uptime and low fees.

- Review Pool Size: Smaller pools might offer higher rewards but can be less stable.

- Validator Reliability: Ensure the validator has a good reputation and history.

Example: Alice picks a high-performing ADA staking pool with reliable uptime.

Step 5: Stake Your Coins

Now it’s time to officially stake your tokens.

- Enter the Staking Amount: Decide how many coins you want to stake.

- Review Staking Terms: Check lock-up duration, fees, and reward frequency.

- Confirm the Transaction: Approve the staking transaction through your wallet.

Example: Alice stakes 1,000 ADA tokens and confirms the transaction via Trust Wallet.

Step 6: Monitor Your Staking Dashboard

Once your tokens are staked, rewards will start accumulating.

- Check Dashboard Regularly: Track your staked amount, earned rewards, and network status.

- Understand Reward Distribution: Some platforms distribute rewards daily, weekly, or monthly.

- Stay Informed: Keep up with platform updates or changes in staking policies.

Example: Alice logs into her staking dashboard weekly to monitor her growing rewards.

Step 7: Claim or Reinvest Your Rewards

Finally, you can decide what to do with your earned rewards.

- Claim Rewards: Withdraw your earned tokens when they become available.

- Reinvest Rewards: Add your rewards back into the staking pool to compound earnings.

- Withdraw Stake (Optional): If your staking period ends or the platform allows flexible staking, you can withdraw your initial stake.

Example: After three months, Alice claims her 50 ADA rewards and decides to reinvest them for compounding growth.

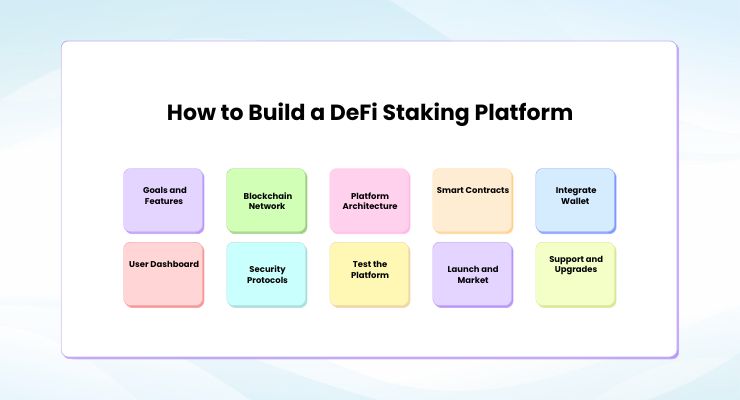

How to Build a DeFi Staking Platform

Building a DeFi staking platform is an exciting venture, but it requires careful planning, technical expertise, and a clear understanding of the DeFi ecosystem. Whether you’re a blockchain developer, entrepreneur, or investor, this guide will walk you through the process step by step. Let’s break it down into an easy-to-follow roadmap.

Step 1: Define Your Platform’s Goals and Features

Before writing any code, you need a clear vision.

- Identify Your Target Audience: Are you targeting individual users, businesses, or institutional investors?

- Choose the Staking Model: Will you support Proof-of-Stake (PoS), Delegated Proof-of-Stake (DPoS), or Liquidity Staking?

- Decide on Key Features: Include features like Flexible Staking, Fixed Staking, a User Dashboard, and Reward Distribution.

- Set Your Reward Mechanism: Define how rewards will be calculated and distributed.

Example: Alex decides to create a Proof-of-Stake staking platform focusing on Ethereum and Solana tokens with both flexible and fixed staking options.

Step 2: Choose the Right Blockchain Network

The underlying blockchain determines the foundation of the best staking platform.

- Popular Choices: Ethereum, Binance Smart Chain (BSC), Solana, Cardano, or Polygon.

- Scalability: Ensure the blockchain can handle large transaction volumes.

- Transaction Costs: Choose networks with low gas fees for users.

- Smart Contract Compatibility: The blockchain must support smart contracts.

Example: Alex chooses Ethereum for its strong developer community and reliability.

Step 3: Design the Platform Architecture

A well-planned architecture ensures smooth operations and scalability.

- Frontend Interface: Design an easy-to-use dashboard for users.

- Backend Infrastructure: Build servers and databases for smooth performance.

- Smart Contracts: Develop and deploy smart contracts for staking, reward distribution, and security.

- Wallet Integration: Ensure compatibility with popular wallets like MetaMask and Trust Wallet.

Example: Alex’s team creates a user-friendly dashboard, integrates MetaMask, and builds smart contracts to automate staking processes.

Step 4: Develop Smart Contracts

Smart contracts are the backbone of any DeFi staking platform.

- Write Secure Smart Contracts: Automate staking, reward calculations, and withdrawals.

- Perform Code Audits: Use third-party services like CertiK or OpenZeppelin for audits.

- Test Thoroughly: Deploy on a testnet (e.g., Ropsten or Binance Testnet) to check functionality and fix bugs.

Key Smart Contract Functions:

- Token Staking Mechanism

- Reward Distribution Logic

- Unstaking and Withdrawal Protocol

- Penalty Rules for Early Unstaking

Example: Alex’s team writes and tests smart contracts on the Ethereum Ropsten Testnet before moving to the mainnet.

Step 5: Integrate Wallet Support

Users need a way to connect their crypto wallets to your platform.

- Popular Wallets: MetaMask, Trust Wallet, Coinbase Wallet, and hardware wallets like Ledger.

- Ensure Compatibility: Your platform must seamlessly interact with these wallets.

- Authorize Transactions: Make sure wallet interactions are secure and user-friendly.

Example: Alex integrates MetaMask and Trust Wallet to allow users to stake their tokens easily.

Step 6: Build a User Dashboard

The dashboard is where users monitor their staking activity.

- Key Features to Include:

- Staked Amount Overview

- Real-Time Reward Tracking

- Withdrawal/Unstaking Options

- Transaction History

- Focus on UX/UI Design: Make the interface intuitive and clean.

Example: Alex’s dashboard shows users their staked tokens, live rewards, and claim options.

Step 7: Implement Security Protocols

Security is non-negotiable in DeFi platforms.

- Use Multi-Layered Security: Include firewalls, DDoS protection, and encryption.

- Smart Contract Audits: Regular third-party code audits are essential.

- Enable Two-Factor Authentication (2FA): Add extra login security layers.

- Bug Bounty Program: Encourage ethical hackers to find vulnerabilities.

Example: Alex partners with CertiK for audits and launches a bug bounty program.

Step 8: Test the Platform Thoroughly

Testing ensures your platform works perfectly before the public launch.

- Internal Testing: Check all functionalities and fix errors.

- Beta Testing: Invite a small group of users to try the platform.

- Stress Testing: Simulate high-traffic scenarios to ensure stability.

Example: Alex runs extensive tests with beta users and resolves reported issues.

Step 9: Launch and Market the Platform

It’s time to go live and attract users.

- Soft Launch: Start with a small group of users to identify last-minute issues.

- Full Launch: Open the platform to the public.

- Marketing Campaigns: Use social media, influencer partnerships, and community forums.

- Educational Content: Publish tutorials and FAQs to help new users.

Example: Alex’s team promotes the platform on Twitter, Discord, and Telegram, while releasing easy-to-follow staking guides.

Step 10: Provide Ongoing Support and Upgrades

A successful platform requires continuous improvement.

- Customer Support: Offer live chat, email, and helpdesk options.

- Regular Updates: Add new features based on user feedback.

- Community Engagement: Build a strong community around your platform.

Example: Alex’s team provides 24/7 support and frequently interacts with users on social media.

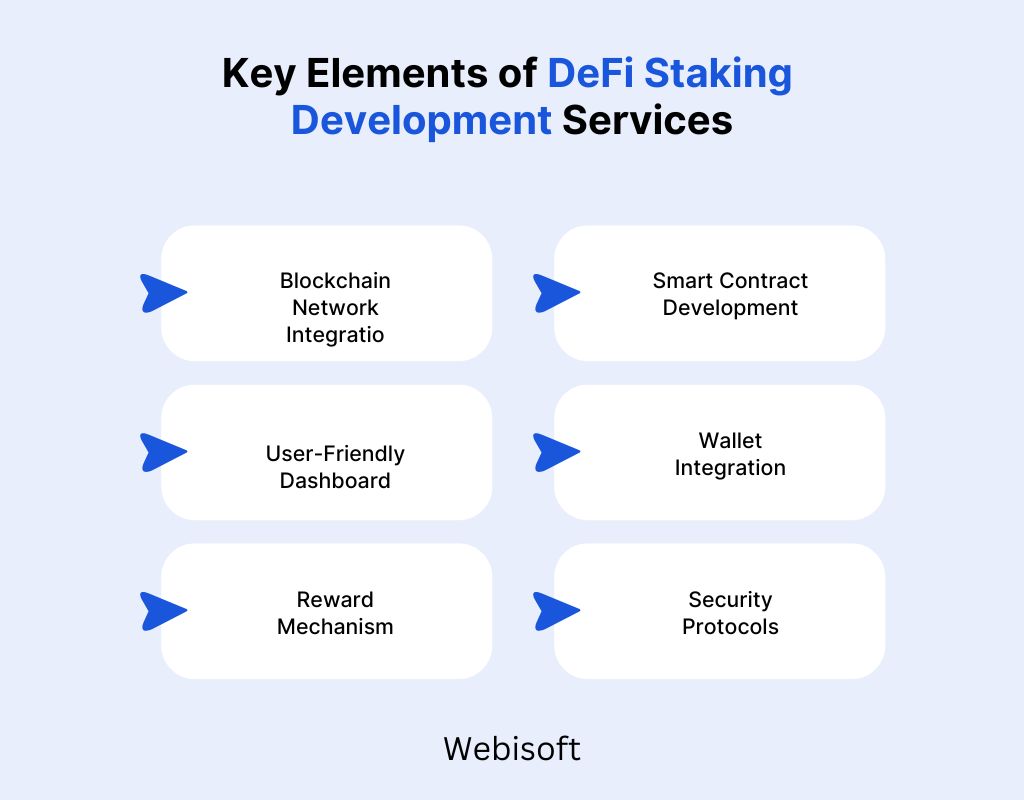

Key Elements of DeFi Staking Development Services

Building a DeFi staking platform requires attention to several critical elements to ensure smooth operation, strong security, and a great user experience. Each element plays a unique role in delivering a reliable and efficient staking service. Let’s break down the key elements of DeFi staking development services in a clear and easy-to-understand way.

1. Blockchain Network Integration

At the core of any DeFi staking platform is a robust and reliable blockchain network.

- Supported Blockchains: Ethereum, Binance Smart Chain, Cardano, Solana, and Polkadot.

- Scalability: The network must handle large transaction volumes efficiently.

- Low Transaction Fees: To encourage more users to stake their assets.

- Smart Contract Compatibility: Ensure seamless interaction with staking protocols.

Why It’s Important: A strong blockchain foundation ensures transparency, efficiency, and trust in the staking process.

2. Smart Contract Development

Smart contracts are the brain of any DeFi staking platform.

- Automated Processes: Handle staking, rewards, and withdrawals without manual intervention.

- Reward Calculation Logic: Accurately calculate staking rewards based on user contributions.

- Security Protocols: Prevent vulnerabilities and loopholes.

- Audit by Experts: Regular audits from trusted firms like CertiK or OpenZeppelin.

Why It’s Important: Secure smart contracts guarantee transparency, eliminate human error, and build user confidence.

3. User-Friendly Dashboard

The user interface is where the magic happens for end-users.

- Easy Navigation: A simple and intuitive design for beginners and experts.

- Staking Overview: Show staked amount, earned rewards, and current status.

- Reward Tracking: Display real-time updates on rewards earned.

- Withdrawal Controls: Easy options to claim rewards or unstake tokens.

Why It’s Important: A clean dashboard ensures users stay engaged and can easily monitor their staking performance.

4. Wallet Integration

Users need secure and smooth ways to connect their wallets to the platform.

- Supported Wallets: MetaMask, Trust Wallet, Coinbase Wallet, Ledger.

- Seamless Connection: Enable one-click wallet integration.

- Secure Transactions: Protect wallet data during authorization.

- Multi-Asset Support: Allow staking for various tokens.

Why It’s Important: Smooth wallet integration simplifies onboarding and ensures safe transactions.

5. Reward Mechanism

The reward structure is a key motivator for users to stake their assets.

- Flexible Reward Options: Daily, weekly, or monthly payouts.

- Compounding Rewards: Allow users to reinvest rewards for higher returns.

- Dynamic APY Rates: Adjust rewards based on market conditions.

- Clear Reward Policies: Transparent rules on how rewards are calculated and distributed.

Why It’s Important: A fair and transparent reward system attracts more users and builds loyalty.

6. Security Protocols

Security is the backbone of any successful DeFi platform.

- End-to-End Encryption: Protect user data and transactions.

- DDoS Protection: Prevent cyberattacks and downtime.

- Smart Contract Audits: Regular third-party audits for vulnerabilities.

- Bug Bounty Programs: Encourage ethical hackers to report security gaps.

Why It’s Important: Strong security builds trust and protects both user funds and platform reputation.

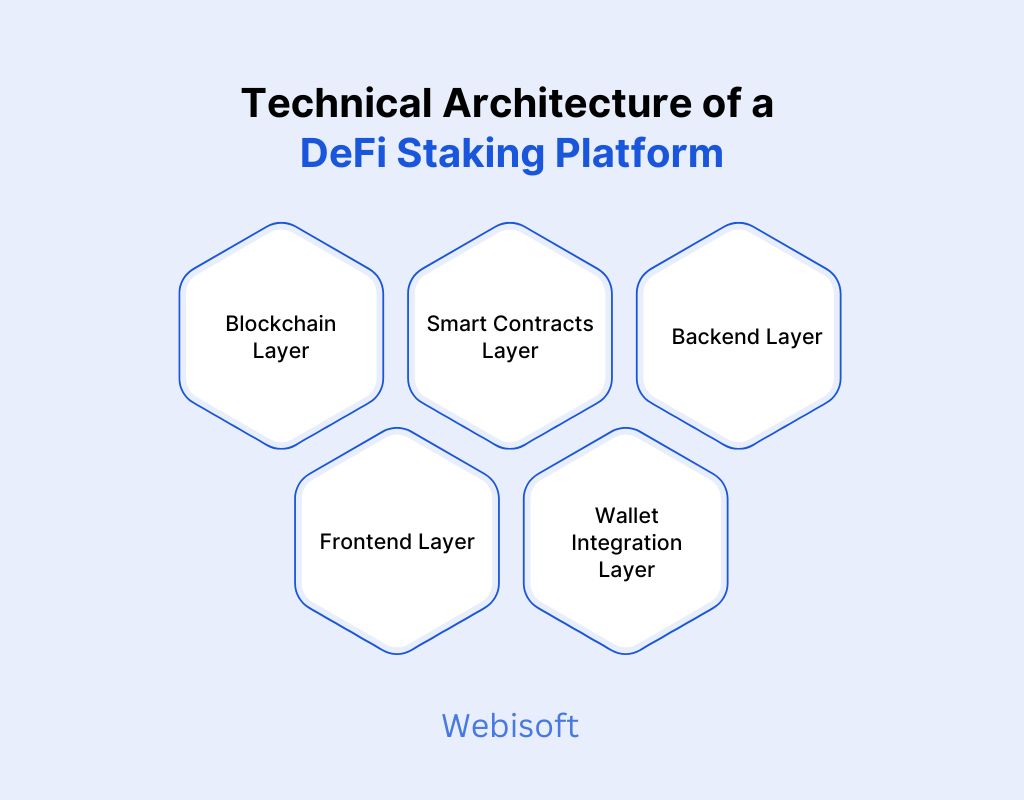

Technical Architecture of a DeFi Staking Platform

A DeFi staking platform relies on a robust and well-designed technical architecture to ensure security, scalability, and seamless user experiences. Each layer of the architecture serves a specific purpose, from processing transactions to securing user funds. Let’s break down the technical architecture of a staking in defi platform into clear and simple layers.

1. Blockchain Layer

At the core of every DeFi staking platform lies the blockchain network. This layer ensures decentralized consensus, transparency, and security.

- Supported Blockchains: Ethereum, Binance Smart Chain, Solana, Polkadot, and Cardano.

- Consensus Mechanisms: Proof-of-Stake (PoS), Delegated Proof-of-Stake (DPoS), or Nominated Proof-of-Stake (NPoS).

- Smart Contract Integration: Contracts are deployed on the blockchain for automating staking operations and rewards.

- On-Chain Data Management: Tracks staked tokens, rewards, and validator performance.

Role: This layer handles all the core logic and data immutability of the staking process.

2. Smart Contracts Layer

Smart contracts are self-executing agreements written in code and deployed on the blockchain.

- Core Functions:

- Stake tokens

- Unstake tokens

- Reward distribution

- Penalty enforcement (for early unstaking)

- Automation: Eliminates intermediaries, ensuring transparency and efficiency.

- Security Audits: Regular audits prevent vulnerabilities and exploits.

Role: Smart contracts act as the brains of the platform, automating staking operations securely.

3. Backend Layer

The backend layer handles off-chain activities, including user requests, database management, and platform logic.

- APIs (Application Programming Interfaces): APIs connect the blockchain, smart contracts, and user interface.

- Transaction Management: Validates and processes user staking and unstacking requests.

- Reward Calculation Engine: Calculates staking rewards based on user contribution and predefined rules.

- Monitoring Services: Tracks validator uptime, user activity, and token balances.

Role: The backend layer serves as the communication bridge between smart contracts, the blockchain, and the frontend.

4. Frontend Layer (User Interface)

This is the user-facing layer where users interact with the staking platform.

- User Dashboard: Displays staked tokens, rewards, and other statistics.

- Wallet Integration: Seamless connection with wallets like MetaMask, Trust Wallet, and Ledger.

- Staking Pools Interface: Users can choose staking pools and manage their tokens.

- Responsive Design: Supports both desktop and mobile devices.

Role: The frontend layer ensures smooth user interactions and easy access to staking features.

5. Wallet Integration Layer

This layer facilitates secure wallet connectivity and token transfers.

- Supported Wallets: MetaMask, Trust Wallet, Coinbase Wallet, Ledger.

- Secure Authorization: Users approve transactions directly from their wallets.

- Token Transfers: Handles staking, unstaking, and reward claims securely.

- Cross-Chain Compatibility: Supports multi-chain token staking.

Role: The wallet layer acts as a gateway between the user and the blockchain, enabling secure asset management.

Security Challenges in DeFi Staking

Security is one of the most critical concerns in DeFi staking platforms. While these platforms offer incredible opportunities for earning passive income, they are also highly vulnerable to various security threats. Understanding these challenges is essential to protect both the platform and its users. Let’s break down the key security challenges in DeFi staking in a clear and practical way.

1. Smart Contract Vulnerabilities

The Challenge: Smart contracts are the backbone of DeFi staking platforms, but they are not immune to bugs or vulnerabilities.

- Common Risks: Logical errors, coding mistakes, and backdoors left by developers.

- Potential Impact: Attackers can exploit vulnerabilities to drain funds or manipulate staking rewards.

- Examples: The DAO Hack (2016) on Ethereum resulted in millions being stolen.

Solution:

- Regular third-party audits (e.g., CertiK, OpenZeppelin).

- Continuous code reviews and updates.

- Bug bounty programs to identify vulnerabilities early.

2. Private Key Management Risks

The Challenge: Users rely on private keys to access their wallets and stake assets. Losing them means losing access to funds forever.

- Common Risks: Phishing attacks, malware, or accidental exposure.

- Potential Impact: Complete loss of staked funds and rewards.

Solution:

- Encourage hardware wallets (e.g., Ledger, Trezor).

- Educate users about secure key storage.

- Enable two-factor authentication (2FA) for added security.

3. Flash Loan Attacks

The Challenge: Flash loans allow users to borrow large sums of crypto without collateral, as long as the loan is repaid in the same transaction. Attackers exploit this feature to manipulate smart contracts.

While vulnerabilities like these exist, DeFi crypto staking remains a powerful and secure way for users to earn rewards and support blockchain networks. Proper risk management and smart contract auditing are essential to minimize these threats.

- Common Risks: Price manipulation, temporary liquidity drainage, or exploiting vulnerabilities in reward calculation mechanisms.

- Potential Impact: Massive financial losses in minutes.

Solution:

- Implement time-locked operations for critical transactions.

- Use decentralized oracles to ensure accurate price feeds.

- Conduct regular vulnerability assessments.

4. Impermanent Loss in Liquidity Staking

The Challenge: When tokens are staked in liquidity pools, price fluctuations can cause losses compared to simply holding the tokens.

- Common Risks: Sudden token price changes or market volatility.

- Potential Impact: Reduced overall staking rewards.

Solution:

- Provide impermanent loss insurance.

- Educate users about market risks.

- Introduce balanced reward systems to offset potential losses.

5. Phishing Attacks and Fake Platforms

The Challenge: Scammers often create fake staking platforms or phishing websites to steal user funds.

- Common Risks: Users unknowingly connect wallets to fake platforms.

- Potential Impact: Loss of staked tokens and personal data exposure.

Solution:

- Always verify website URLs.

- Enable domain authentication on platforms.

- Educate users about identifying phishing attempts.

Regulatory Considerations for DeFi Staking Platforms

DeFi staking operates in a rapidly evolving regulatory landscape. Governments and financial authorities worldwide are still figuring out how to classify, monitor, and regulate decentralized financial systems. For developers, investors, and users, understanding regulatory considerations is essential to avoid legal complications and ensure compliance.

Let’s explore the key regulatory considerations for DeFi staking platforms in an easy-to-understand way.

1. Legal Classification of DeFi Staking

The Challenge: Regulators often struggle to classify DeFi staking activities. Is it a security, a commodity, or a financial service?

- Inconsistent Classifications: Different countries classify staking rewards differently (e.g., interest income, capital gains, or dividends).

- Potential Impact: Misclassification can lead to hefty fines or platform shutdowns.

What to Do:

- Consult with legal experts specializing in blockchain regulations.

- Monitor how local authorities classify staking activities.

- Stay updated on international regulatory trends (e.g., U.S. SEC guidelines, EU MiCA regulations).

2. Know Your Customer (KYC) and Anti-Money Laundering (AML) Compliance

The Challenge: DeFi platforms often emphasize anonymity, but regulators require KYC and AML procedures to prevent fraud and money laundering.

- AML Compliance: Platforms must track and report suspicious activities.

- KYC Requirements: Platforms may be required to verify user identities.

- Potential Impact: Non-compliance can result in legal action and reputational damage.

What to Do:

- Implement optional or mandatory KYC procedures for high-value staking activities.

- Use automated AML monitoring tools.

- Comply with Financial Action Task Force (FATF) guidelines.

3. Taxation Policies

The Challenge: Tax authorities require staking rewards to be reported as taxable income, but rules vary by country.

- Taxable Events: Are rewards taxed when earned or when withdrawn?

- Complex Calculations: Tracking staking rewards across multiple protocols can be challenging.

- Potential Impact: Misreporting can lead to audits, fines, or penalties.

What to Do:

- Provide users with transparent reward tracking and tax reports.

- Collaborate with accounting tools like TokenTax or Koinly.

- Educate users on their tax obligations based on their jurisdictions.

4. Securities Regulations

The Challenge: If staking tokens are classified as securities, platforms may need to register with regulatory authorities (e.g., SEC in the USA).

- Token Classification: Security tokens vs. utility tokens.

- Legal Compliance: Platforms offering staking services might be required to file paperwork or limit services to accredited investors.

- Potential Impact: Non-compliance could lead to restrictions or fines.

What to Do:

- Avoid promoting staking products as investment contracts.

- Work with legal teams to determine if tokens fall under security laws.

- Follow local securities regulations carefully.

5. Cross-Border Jurisdiction Issues

The Challenge: DeFi platforms often serve a global audience, but regulations vary greatly across countries.

- Jurisdictional Conflicts: Some countries may ban staking entirely, while others regulate it.

- Legal Ambiguity: Which country’s laws apply in a decentralized protocol?

- Potential Impact: Platforms could face legal action in multiple jurisdictions.

What to Do:

- Restrict access in regions with unclear or hostile regulations.

- Clearly state legal jurisdictions in the platform’s Terms of Service.

- Use geo-blocking if necessary.

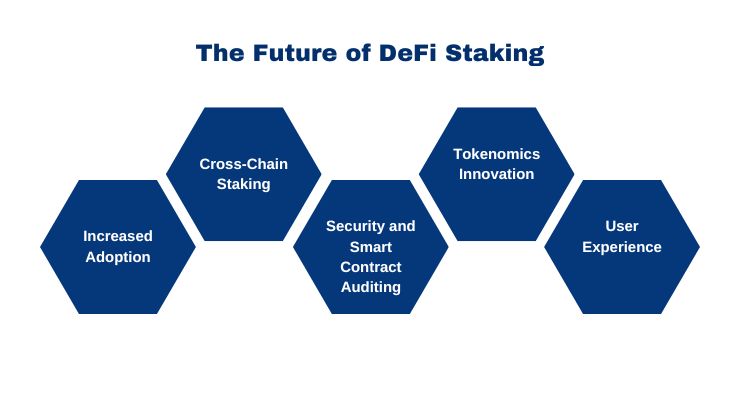

The Future of DeFi Staking

DeFi staking is rapidly evolving, and its future looks incredibly promising. As blockchain technology advances and adoption grows, staking is set to become a cornerstone of decentralized finance. Let’s explore the key trends shaping the future of DeFi staking and what we can expect in the coming years.

1. Increased Adoption by Institutions

- Traditional financial institutions are showing growing interest in DeFi staking.

- Banks and asset management firms are exploring blockchain networks for staking opportunities.

- Institutional-grade staking services are emerging to cater to large investors.

What It Means: Increased legitimacy, larger capital inflows, and better staking infrastructure.

2. Cross-Chain Staking

- Multi-chain and cross-chain staking will allow users to stake tokens across different blockchain networks seamlessly.

- Platforms like Cosmos (ATOM) and Polkadot (DOT) are already pioneering this trend.

What It Means: More flexibility, higher interoperability, and reduced blockchain silos.

3. Enhanced Security and Smart Contract Auditing

- Advanced auditing tools and AI-driven vulnerability detection will become standard practices.

- Decentralized insurance protocols will grow to protect staked assets.

What It Means: Safer staking environments and fewer vulnerabilities.

4. Tokenomics Innovation

- Dynamic reward structures will adapt to market conditions.

- New incentive mechanisms will emerge to attract long-term stakers.

What It Means: More sustainable reward systems and reduced inflationary risks.

5. Improved User Experience (UX)

- Platforms will focus on offering intuitive, beginner-friendly interfaces.

- Simplified wallet integrations and mobile apps will drive mainstream adoption.

What It Means: Wider accessibility and a smoother onboarding process.

Real-World Case Studies of Successful DeFi Staking Platforms

Real-world examples provide valuable insights into how successful DeFi staking platforms operate. Below are three key case studies of platforms that have achieved significant success in the world of DeFi staking.

1. Ethereum 2.0 (ETH 2.0)

Overview: Ethereum 2.0 transitioned from Proof-of-Work (PoW) to Proof-of-Stake (PoS) to improve scalability and energy efficiency.

Key Achievements:

- Over 20 million ETH staked as of 2023.

- Participation from both individual and institutional validators.

- Reduced energy consumption by over 99% compared to PoW.

Why It’s Successful:

- Strong community support and developer ecosystem.

- Clear staking incentives with sustainable tokenomics.

- Robust security measures and frequent audits.

Key Takeaway: Ethereum 2.0 set the gold standard for large-scale staking networks.

2. Lido Finance (Liquid Staking Protocol)

Overview: Lido allows users to stake tokens while maintaining liquidity, enabling them to use their staked assets in other DeFi protocols.

Key Achievements:

- Supports assets like ETH, SOL, and MATIC.

- Over $10 billion worth of assets staked via the platform.

- Enabled seamless DeFi participation without sacrificing staking rewards.

Why It’s Successful:

- Pioneered the concept of liquid staking.

- Strong partnerships with DeFi protocols like Curve Finance and Aave.

- User-friendly interface and transparent operations.

Key Takeaway: Lido demonstrates how innovation can maximize staking capital efficiency.

3. PancakeSwap (CAKE Staking Pools)

Overview: PancakeSwap, built on Binance Smart Chain, offers staking pools for its native token, CAKE.

Key Achievements:

- Millions of users actively participate in staking pools.

- Flexible and fixed staking options cater to different risk profiles.

- Strong liquidity incentives drive participation.

Why It’s Successful:

- Easy-to-use interface, even for beginners.

- Low transaction fees on Binance Smart Chain.

- Continuous reward optimizations and user engagement programs.

Key Takeaway: PancakeSwap shows how accessible interfaces and attractive reward structures drive user adoption.

Comparison Table of Successful Platforms

| Platform | Blockchain | Key Innovation | Achievements | Best For |

| Ethereum 2.0 | Ethereum | Proof-of-Stake (PoS) | 20M+ ETH staked | Long-term investors |

| Lido Finance | Multi-Chain | Liquid Staking Protocol | $10B+ assets staked | Flexible liquidity stakers |

| PancakeSwap | Binance Smart Chain | Yield Farming + Staking | Millions of active users | Beginner-friendly staking |

Lessons Learned from These Case Studies:

- Innovation Drives Success: Platforms like Lido succeeded by introducing liquid staking.

- User Experience Matters: PancakeSwap’s simple interface attracts beginners.

- Community is Key: Ethereum 2.0 thrives on strong community and developer support.

- Scalability and Security are Essential: All platforms prioritize scalability and smart contract security.

Webisoft: Your Trusted Partner for DeFi Staking Platform Development

In the ever-evolving world of Decentralized Finance (DeFi), Webisoft stands as your reliable partner to turn ambitious ideas into powerful, secure, and scalable DeFi staking platform development services. With a team of experienced blockchain developers, security experts, and fintech innovators, we are committed to delivering platforms that drive trust, efficiency, and profitability in the decentralized world.

Proven Expertise in DeFi Development

At Webisoft, we bring years of hands-on experience in building and launching successful DeFi projects. Our team understands the complexities of blockchain protocols and delivers solutions tailored to the unique needs of each client. From Proof-of-Stake (PoS) platforms to advanced liquid staking protocols, we’ve done it all.

Security-First Approach

Security is at the heart of every project we build. Our smart contracts undergo rigorous audits by trusted third-party firms to ensure they are free from vulnerabilities. With advanced encryption protocols, DDoS protection, and regular code reviews, we keep your platform and users’ assets safe.

Customizable and Scalable Solutions

Every project is unique, and so are our solutions. We offer fully customizable staking platforms designed to scale as your user base grows. Whether you’re building a single-chain or cross-chain staking system, we’ve got you covered.

Seamless Wallet Integration

We ensure smooth and secure wallet integration with popular wallets like MetaMask, Trust Wallet, and Ledger. Users can easily connect their wallets and start staking with just a few clicks, enhancing both usability and trust.

Intuitive User Experience

A user-friendly interface can make or break a platform. Our team focuses on clean, intuitive dashboards where users can monitor staking progress, claim rewards, and track transactions in real time — even if they’re beginners.

Transparent Reward Mechanisms

Transparency builds trust. Our platforms offer clear reward structures with real-time updates on earnings. Whether it’s fixed or flexible staking rewards, users always know what to expect.

Cross-Chain Compatibility

The future is multi-chain, and we are ready for it. Our platforms support cross-chain staking, allowing users to stake tokens across Ethereum, Binance Smart Chain (BSC), Polygon, and more.

Post-Launch Support and Maintenance

Building the platform is just the beginning. Our dedicated support team provides 24/7 assistance, performance monitoring, and regular updates to ensure your platform remains secure, fast, and bug-free.

At Webisoft, we combine technical excellence, industry experience, and a passion for innovation to deliver DeFi staking platforms that are secure, scalable, and built for long-term success.

Let’s turn your vision into reality and build the future of DeFi staking together!

Conclusion

DeFi staking is more than just a trend — it’s a game-changing way to earn, grow, and contribute to the future of finance. It lets users earn passive income, secure blockchain networks, and have a voice in important decisions. And the best part? It’s accessible to anyone with an internet connection and a crypto wallet.

But here’s the thing — building a successful DeFi staking platform isn’t easy. It takes technical expertise, strong security, and a smooth user experience. That’s where Webisoft comes in.

We don’t just build platforms; we build trust, reliability, and growth opportunities. From planning to deployment and ongoing support, we’ll be by your side every step of the way.

And guess what? The future of finance is already here, and DeFi usdt staking is leading the charge. Together, we can create something powerful, secure, and user-friendly.

Frequently Asked Questions [FAQs]

1. How can I start staking my crypto assets?

Starting is easier than it sounds. First, choose a trusted DeFi platform like Ethereum 2.0 or Lido. Then, set up a crypto wallet such as MetaMask. After that, transfer your tokens and connect your wallet to the platform. Finally, select a staking pool and confirm. You’re ready!

2. What happens if I want to withdraw my staked tokens early?

This depends on your staking type. With flexible staking, you can withdraw anytime, but rewards might be lower. In fixed staking, tokens are locked for a set time. Early withdrawals may come with penalties. Always check the platform’s rules before committing.

3. How much can I earn through DeFi staking?

Your earnings depend on how much you stake, the APY (Annual Percentage Yield), and any platform fees. For example, staking 10 ETH with a 5% APY could earn you 0.5 ETH per year. Some platforms even offer bonus rewards for long-term commitments.

4. Is my staked crypto safe?

Your crypto is generally safe on trusted platforms with audited smart contracts. But yes, risks exist. Bugs, platform failures, or market volatility can impact your investment. To stay safe, always use reputable platforms, secure your wallet, and diversify your assets.

5. Do I need technical knowledge to stake my crypto?

No, you don’t need to be tech-savvy. Most platforms are designed with simple dashboards and easy-to-follow steps. Wallet connections are quick, and staking is usually just a few clicks away. And if you get stuck, customer support is always there to help.

6. What are the main differences between DeFi staking and traditional finance savings accounts?

DeFi staking gives you full control of your assets, while banks hold your money. Rewards in DeFi are usually higher but come with more risks. Banks offer lower returns but more stability. In DeFi, everything is transparent through smart contracts.

7. Are staking rewards considered taxable income?

Yes, in most countries, staking rewards are taxable income. Typically, rewards are taxed when you receive them and again if you sell them for profit. To stay safe, keep detailed records and use tools like Koinly. Always consult a tax professional.