Blockchain Technology Explained: A Simple Guide for Everyone

- BLOG

- Blockchain

- October 10, 2025

Blockchain is a technology that’s changing the way we store, verify, and exchange information in the digital age. While it first gained attention as the foundation for Bitcoin, blockchain has grown far beyond cryptocurrency. Today, it powers solutions in finance, healthcare, logistics, identity management, and many other industries.

Contents

- 1 What is Blockchain Technology?

- 2 From Bitcoin to Broader Adoption

- 3 Why Is Blockchain Considered Revolutionary?

- 4 A Brief History of Blockchain Technology

- 5 How Does Blockchain Work?

- 6 Key Features and Benefits of Blockchain

- 7 Types of Blockchains: Public, Private, Consortium, and Hybrid

- 8 Blockchain Use Cases in the Real World

- 9 Blockchain vs Traditional Systems

- 10 Limitations and Challenges of Blockchain Technology

- 11 Blockchain and Smart Contracts

- 12 Blockchain Security and Risks

- 13 Future of Blockchain Technology

- 14 Frequently Asked Questions About Blockchain

What is Blockchain Technology?

Think of blockchain as a shared digital ledger or database. It records transactions in a way that is secure, transparent, and nearly impossible to tamper with. Unlike traditional databases controlled by a single organization, blockchain runs across a network of computers. Everyone on the network holds a copy of the same data, so no single party has full control.

At a technical level, blockchain is a decentralized and distributed ledger. It organizes data into “blocks.” Each block includes a group of transactions, a timestamp, and a cryptographic hash that links it to the block before it. This connection forms a chain. Once data is added to the chain, changing it would require altering all the following blocks — something that is extremely difficult, which helps keep the system secure.

From Bitcoin to Broader Adoption

Blockchain technology entered the world in 2008 when Satoshi Nakamoto introduced it through the Bitcoin whitepaper. Bitcoin showed how blockchain could enable trustless money — a way for people to send value without needing banks or governments to verify transactions.

Since then, blockchain has evolved well beyond digital currency. Ethereum added the idea of smart contracts, making it possible to create decentralized applications. This innovation gave rise to decentralized finance (DeFi), where users can borrow, lend, and trade without intermediaries. Beyond finance, blockchain now plays a role in supply chain tracking, digital identity systems, voting platforms, and even digital art through NFTs.

Why Is Blockchain Considered Revolutionary?

Blockchain changes how trust is built in digital systems. Instead of relying on one central body to confirm that data is accurate, blockchain uses consensus — a process where network participants agree on what’s true. This can be done through methods like Proof of Work or Proof of Stake.

The result is a system that offers:

- Trustless interaction: No need for users to trust each other or a central authority.

- Data immutability: Once recorded, data stays as it is unless the entire network agrees to change it.

- Strong security: Encryption and distributed consensus make hacking or tampering extremely difficult.

In a world where privacy, censorship resistance, and transparency are becoming more important, blockchain offers an alternative to traditional systems that many see as outdated.

Blockchain vs Traditional Databases

| Feature | Blockchain | Traditional Database |

| Control | Decentralized (no single owner) | Centralized (controlled by one entity) |

| Trust Model | Trustless via consensus | Trust in the administrator |

| Data Integrity | Immutable and transparent | Can be edited or deleted |

| Performance | Slower (due to consensus) | Faster (centralized control) |

| Use Cases | Finance, supply chain, digital identity | General-purpose data storage |

While traditional databases remain essential for many applications, blockchain excels in multi-party environments where trust, security, and transparency are critical. It doesn’t replace databases — it reimagines them for decentralized coordination.

A Brief History of Blockchain Technology

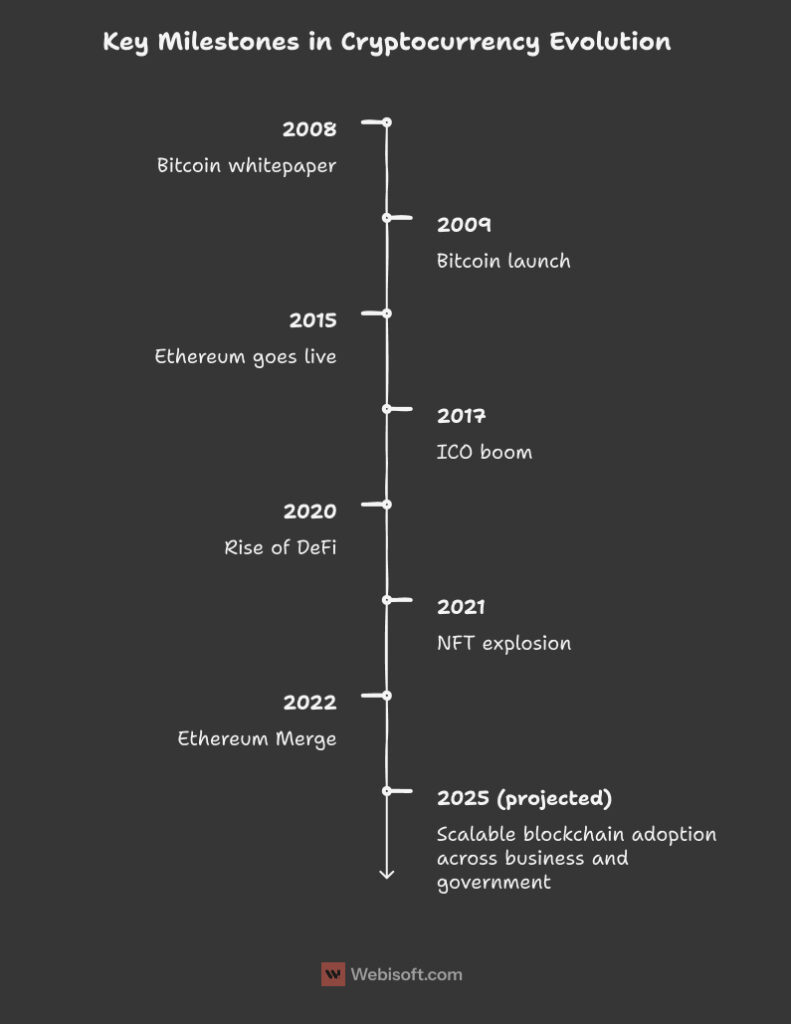

Blockchain’s origins lie in the quest for a digital system where trust doesn’t depend on intermediaries. While the term “blockchain” rose to fame with Bitcoin, the ideas behind it had been in development for years before.

The Pre-Bitcoin Era: Distributed Ledgers

Before Bitcoin, researchers and computer scientists were already working on distributed systems that could maintain consistent records across multiple nodes. Cryptography and concepts like Byzantine fault tolerance laid the foundation for blockchain. Early experiments, including Hashcash (created to reduce email spam) and b-money (a digital cash proposal), pointed in the right direction but never reached widespread adoption.

2008–2009: The Birth of Blockchain

The breakthrough moment came in 2008 when Satoshi Nakamoto published the Bitcoin whitepaper. It described a peer-to-peer electronic cash system that worked without banks or governments. Instead, transactions were verified using cryptographic proof.

In 2009, Bitcoin’s network went live, introducing blockchain to the real world. This system brought together a decentralized ledger, Proof of Work consensus, and token-based incentives. For a deeper look at Bitcoin’s structure and its pioneering role in blockchain history, you might also find our What Is a Block Explorer? guide useful.

2015: Ethereum and the Era of Smart Contracts

Bitcoin proved blockchain could power digital currency. Ethereum, launched in 2015, expanded that vision. By adding smart contracts (code that runs automatically on-chain), Ethereum allowed developers to build decentralized apps for everything from finance to gaming. This sparked the rise of DeFi protocols and NFT marketplaces. Our blockchain product development services often help teams design applications powered by these kinds of smart contracts.

2017–2022: Enterprise Adoption and the DeFi Boom

Blockchain’s potential caught the attention of businesses during this period. Enterprises began building private and permissioned blockchains, with platforms like Hyperledger Fabric and Corda leading the way for use cases such as supply chain tracking and digital identity management. If enterprise applications interest you, our enterprise blockchain development service outlines how we help organizations integrate these solutions.

Public blockchains, meanwhile, saw massive growth:

- The ICO boom of 2017 raised billions in crypto funding.

- DeFi platforms like Compound, Uniswap, and Aave gained major traction in 2020.

- NFTs exploded onto the mainstream scene in 2021.

- Ethereum’s 2022 transition to Proof of Stake reduced its energy footprint and marked a turning point in blockchain sustainability.

2023–2025: Maturity and Integration

Today, blockchain is moving toward broader integration with real-world systems. We’re seeing advances like Layer 2 networks (Arbitrum, Optimism) improving transaction speeds, pilot programs for central bank digital currencies, and growing efforts in cross-chain interoperability. Privacy-preserving protocols are also becoming a key focus, helping blockchain meet regulatory and user expectations.

Visual Suggestion: A timeline graphic showing key milestones:

- 2008: Bitcoin whitepaper

- 2009: Bitcoin launch

- 2015: Ethereum goes live

- 2017: ICO boom

- 2020: Rise of DeFi

- 2021: NFT explosion

- 2022: Ethereum Merge

- 2025 (projected): Scalable blockchain adoption across business and government

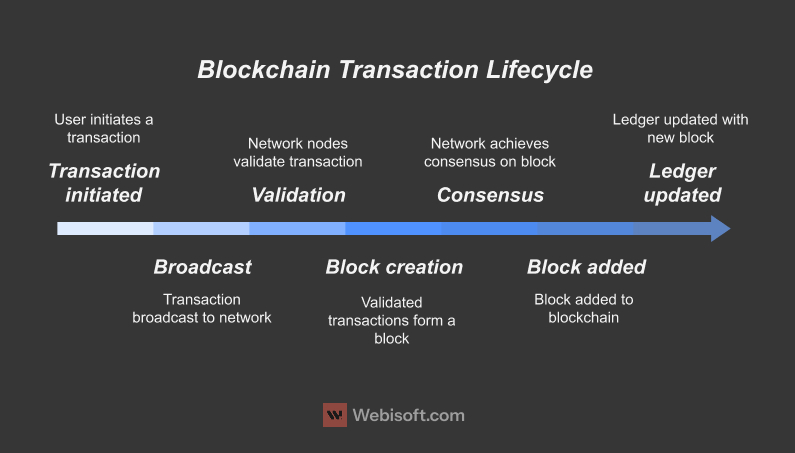

How Does Blockchain Work?

To understand blockchain, it helps to look at how data is structured, secured, verified, and shared. At its core, blockchain is a system where a network of participants keeps a shared record of information. This happens without relying on a single central authority to confirm what’s true.

Let’s break it down step by step.

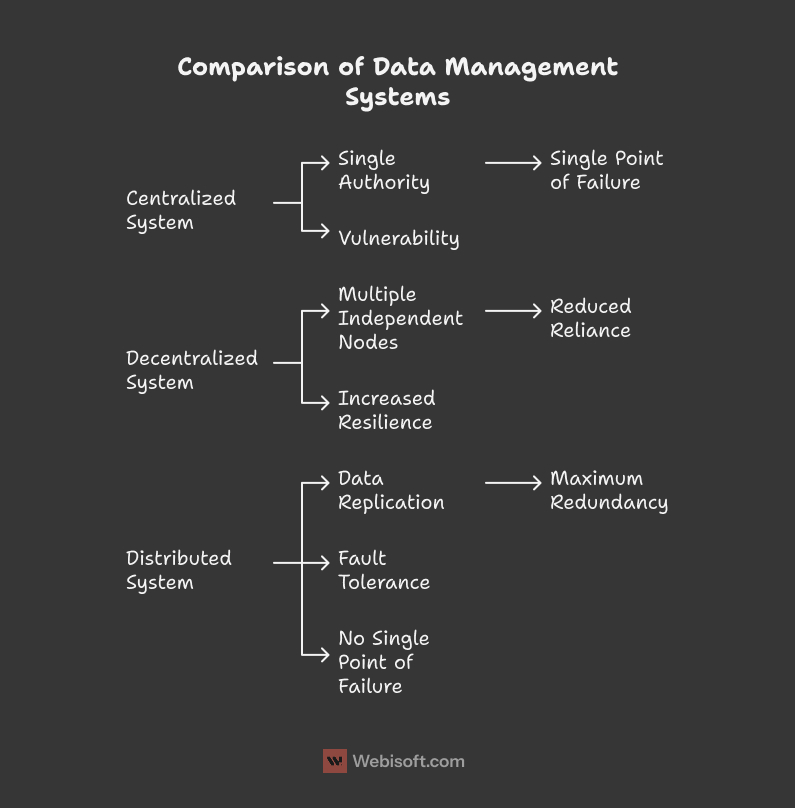

Distributed Ledger Technology (DLT)

Blockchain is built on the idea of Distributed Ledger Technology (DLT). This means data is not stored on one central server. Instead, it’s kept across a network of computers, called nodes. Every participant has a synchronized copy of the ledger, and whenever a transaction happens, it’s broadcast to the entire network. Once approved, the update appears in every copy.

This design removes the need for a central middleman and makes the system harder to manipulate or take down. DLT’s ability to boost trust and transparency is one reason why it’s being explored in industries like supply chain, healthcare, and digital identity. You can see this in action in use cases we cover in blockchain for hospitals, where data security is critical.

Blocks and Chains

Blockchain gets its name from the way it organizes information: in blocks that link together to form a chain. Each block contains:

- A list of transactions

- A timestamp

- A cryptographic hash of the previous block

- A nonce (used in consensus calculations)

When a block is complete, it connects to the previous one. This forms a chain where changing a single block would require altering all the blocks that come after it. Doing that would take enormous computing power, making blockchain highly tamper-resistant.

If you’re curious how these links between blocks help with transparency, our guide on blockchain indexing protocols offers more detail on how data is organized for easy verification.

Cryptographic Hashing

A cryptographic hash function takes input and produces a fixed-length string that looks random. Even a tiny change to the input creates a completely different hash. This is known as the avalanche effect.

For example:

- Input: Blockchain

- SHA-256 output: c6a7a29d3b…3e831fa601c5f3b

Key properties of cryptographic hashing:

- It’s one-way — you can’t work backward from the hash to figure out the original input

- The same input always gives the same hash

- It’s incredibly rare for two different inputs to produce the same hash

Hashes are what link blocks together, prove data integrity, and drive mining in networks like Bitcoin. If you’re looking to build with secure blockchain structures, explore how our custom blockchain development services help teams implement these foundations.

Consensus Mechanisms

Blockchains don’t have a central server to decide what’s valid. Instead, they use consensus algorithms so participants can agree on which transactions are legitimate. Popular methods include:

- Proof of Work (PoW): Used by Bitcoin. Miners solve puzzles to add new blocks. It’s very secure but energy-heavy.

- Proof of Stake (PoS): Used by Ethereum after its Merge. Validators are selected based on how many tokens they stake. It’s faster and more energy-efficient.

- Delegated Proof of Stake (DPoS): Used by EOS. Token holders elect trusted validators. It’s more scalable but brings a level of centralization.

Consensus ensures the network stays in sync and protects against fraud, double-spending, or bad actors. You can learn more about these models in our article on Proof of Stake in Blockchain.

Validation and Block Addition

When someone starts a transaction, the process works like this:

- The transaction is shared across the network.

- Nodes check if it meets the rules (for example, does the sender have enough funds?).

- Valid transactions are grouped into a new block.

- The network uses consensus to add the block to the chain.

- Every node updates its copy of the ledger.

This process ensures the data is accurate and permanent. Once a block is in the chain, changing it is nearly impossible — which is what gives blockchain its reliability.

Together, these components enable blockchain to function as a trustless, decentralized, and secure digital infrastructure, making it ideal for multi-party systems where trust is hard to establish.

Key Features and Benefits of Blockchain

Blockchain technology offers a set of unique features that set it apart from traditional systems. These features are reshaping how industries build trust, improve transparency, and enhance efficiency. Let’s break down the core benefits that give blockchain its value.

Decentralization

Decentralization is at the heart of what makes blockchain powerful. Rather than depending on a single server or central authority, blockchain networks are maintained by a distributed group of nodes. This structure means no one entity controls the system. As a result, the network is far more resilient against censorship, tampering, or failures.

Open networks like Bitcoin and Ethereum invite anyone to join, validate transactions, and help maintain the ledger. This open participation model strengthens trust and reduces risks tied to single points of failure — something many legacy systems still struggle with. To see how decentralization supports entire ecosystems, check out our deep dive on decentralized finance (DeFi).

Transparency and Immutability

Every transaction on a blockchain is recorded on a ledger that anyone in the network can view. This level of transparency helps ensure accountability, whether in supply chains, financial reporting, or public sector records.

Once data is written to the blockchain, it becomes nearly impossible to alter without agreement from the majority of the network. This immutability is a key reason blockchain is trusted for fraud prevention and audit trails. For example, our blockchain compliance services help businesses implement solutions that meet strict transparency and audit requirements in regulated industries.

Security

Blockchain’s design combines cryptographic hashing, distributed consensus, and incentive mechanisms to create a secure system. Each transaction is encrypted and linked to the one before it, creating a chain that can’t be changed without enormous effort. In Bitcoin, for instance, miners must solve complex puzzles to add new blocks — making fraud attempts extremely costly.

While large networks are highly secure, it’s worth knowing that smaller blockchains could face risks like a 51% attack, where one party gains majority control. For those interested in securing blockchain-based platforms, our article on blockchain cybersecurity covers key safeguards and risks.

Efficiency and Cost Reduction

Blockchain boosts efficiency by removing the need for middlemen. Smart contracts — programs that run automatically on the blockchain — let users complete transactions without brokers, banks, or legal notaries. This reduces costs and speeds up processes in finance, real estate, insurance, and more.

In the DeFi space, for example, people can lend or borrow crypto directly through a smart contract that manages loan terms without a bank involved. You can explore more about these automated financial systems in our resource on DeFi apps.

Traceability and Auditability

One of blockchain’s strengths is its ability to provide clear, permanent records of every transaction. This makes it ideal for tracking goods in supply chains, managing sensitive healthcare data, or ensuring financial transparency. Each action is time-stamped and stored forever, which helps with real-time traceability and easier audits.

Companies use blockchain to trace products from their source to the final customer, helping reduce fraud and provide transparency to regulators. Our blockchain supply chain solutions illustrate how businesses are using this technology for full lifecycle tracking.

Types of Blockchains: Public, Private, Consortium, and Hybrid

Not all blockchains work the same way. Depending on the level of access, control, and trust model, blockchains can be grouped into four main types: public, private, consortium, and hybrid. Each is suited to different use cases — from decentralized finance to enterprise systems.

Public Blockchain

Public blockchains are fully open networks. Anyone can join, read data, write transactions, or help validate the ledger. These systems use consensus algorithms like Proof of Work or Proof of Stake to secure the network without relying on a central authority.

Examples include Bitcoin and Ethereum.

Key characteristics:

- Permissionless — no approvals needed to join

- Transparent — transactions are visible to all participants

- Secure — decentralization makes tampering extremely difficult

Best for:

- Cryptocurrencies and digital payments

- Decentralized apps (dApps)

- Open-source ecosystems

While public blockchains offer high security and openness, they can face challenges with speed and scalability. You can explore these trade-offs further in our guide on blockchain scalability.

Private Blockchain

Private blockchains are permissioned systems. Access is limited to approved participants, making them ideal for businesses that need control over data and operations.

A well-known example is Hyperledger Fabric.

Key characteristics:

- Centralized or semi-centralized governance

- Higher throughput thanks to fewer validators

- Flexible privacy settings

Best for:

- Internal business processes

- Supply chain tracking

- Enterprise identity systems

Private blockchains are often part of enterprise solutions where efficiency and privacy matter more than decentralization. Our private blockchain development services help businesses implement these systems securely.

Consortium Blockchain

Consortium blockchains create a shared network governed by multiple organizations. No single entity controls the system, which supports collaboration while keeping operations efficient.

Examples include Corda and Quorum.

Key characteristics:

- Governance shared by pre-approved entities

- Balanced performance and decentralization

- Efficient consensus

Best for:

- Banking partnerships and trade finance

- Multi-company data sharing

- Cross-border transaction networks

Consortium chains are often used in industries that need both cooperation and privacy. You can see how this model works in our article on blockchain in banking.

Hybrid Blockchain

Hybrid blockchains combine features of both public and private systems. This structure lets organizations keep some data private while interacting with a public blockchain for transparency or external validation.

Examples include XDC Network and IBM Food Trust.

Key characteristics:

- Mix of public openness and private control

- Selective data sharing for compliance or audit purposes

- Scalable and customizable

Best for:

- Public sector records

- Corporate platforms that need both privacy and transparency

- Industry solutions where compliance is key

We also have an extensive guide published on Types of Blockchain.

Hybrid systems offer flexibility but require careful design and integration. To learn how these architectures support complex needs, visit our page on custom blockchain app development.

Comparison Table: Blockchain Types

| Type | Access Level | Governance | Pros | Cons | Examples |

| Public | Open to all | Fully decentralized | Transparency, trustless, censorship-resistant | Slower, energy-intensive, less privacy | Bitcoin, Ethereum |

| Private | Restricted (by invite) | Centralized or semi-centralized | Fast, private, customizable | Limited trust, not transparent | Hyperledger Fabric |

| Consortium | Controlled by group | Shared among orgs | Efficient, shared trust, scalable | Requires cooperation and governance | Corda, Quorum |

| Hybrid | Mix of open + private | Flexible | Balance of transparency & privacy | Complex design and maintenance | XDC Network, IBM Food Trust |

Each type of blockchain serves a unique purpose. The right choice depends on your use case, industry, and trust model. As blockchain adoption evolves, hybrid and consortium models are gaining traction in real-world business environments.

Blockchain Use Cases in the Real World

Blockchain is no longer just the technology behind cryptocurrencies. It’s reshaping industries by offering transparency, security, and decentralized solutions that address long-standing inefficiencies. Here’s how blockchain is making a real impact across sectors.

Finance and Banking

The financial world was blockchain’s first proving ground — and it remains one of the most transformed sectors.

- Cross-border payments: Traditional remittance systems are slow and expensive. Blockchain enables faster, cheaper global transfers. Networks like Ripple and Stellar are working with banks to modernize international payments. You can see how these innovations compare in our article on blockchain in cross-border payments.

- Decentralized finance (DeFi): Platforms like Uniswap and Aave let users lend, borrow, and trade without banks, using smart contracts that automatically handle transactions.

- Digital identity and KYC: Blockchain supports secure identity storage and verification, helping reduce fraud. This technology is also part of solutions we offer in blockchain compliance services.

The result is faster transactions, lower fees, and greater financial inclusion.

Supply Chain Management

Supply chains today are complex, with limited transparency. Blockchain makes it easier to trace goods and build trust at every step.

- Product tracking: Initiatives like IBM Food Trust allow companies to trace food from farm to shelf, helping identify contamination sources quickly.

- Transparency: Retailers, including Walmart, are using blockchain to confirm product origin and ensure ethical sourcing. Our blockchain inventory management solutions support these kinds of traceable, tamper-resistant records.

This visibility reduces fraud, boosts efficiency, and builds consumer confidence.

Healthcare

Healthcare systems need better data security and sharing. Blockchain helps unify and protect patient records.

- Patient data sharing: Platforms like Medicalchain support the safe exchange of health records between providers and patients.

- Data ownership: Blockchain lets patients control access to their records, improving privacy and compliance. To see how this applies to the medical field, explore our piece on blockchain in healthcare.

Blockchain reduces admin overhead while keeping data accurate and secure.

Real Estate

Property deals often suffer from paperwork delays and fraud risks. Blockchain streamlines these processes.

- Tokenization: Real estate can be divided into digital shares, making property investments more accessible.

- Title verification: Immutable records reduce disputes over property ownership.

- Smart contracts: Transactions can be automated, so funds release as soon as conditions (like title clearance) are met. Our blockchain app development services help teams build these types of solutions.

Voting Systems

Blockchain can improve elections by making voting secure, transparent, and tamper-resistant.

- Digital voting: Secure apps can verify that each voter casts only one ballot, and that votes can’t be altered.

- Audit trails: Every vote is recorded in a way that allows easy recounts and fraud detection.

Pilot programs in places like Estonia and some U.S. districts show how blockchain could support digital democracy.

NFTs and Digital Ownership

Blockchain is powering new digital economies where ownership is verifiable and assets are tradable.

- NFTs: Artists, musicians, and game developers use NFTs to monetize digital works while securing royalty streams.

- Gaming and metaverse: In platforms like Axie Infinity, players own and trade in-game items as NFTs. Our metaverse NFT marketplace development services explore how these virtual economies are built.

- Virtual real estate: Platforms like Decentraland let users buy and sell land with proof of ownership recorded on-chain.

Real-World Use Cases

- Unilever tracks tea supply chains to ensure ethical sourcing.

- Estonia runs a blockchain-based national ID system supporting healthcare, voting, and e-residency.

- JP Morgan uses JPM Coin for real-time cross-border settlements.

- Provenance.org verifies sustainability and ethical claims for brands using blockchain records.

Blockchain’s role in real-world systems is growing. As adoption deepens, we can expect more industries to embrace its potential for efficiency, trust, and empowerment.

Blockchain vs Traditional Systems

As blockchain adoption accelerates, it’s helpful to understand how it stacks up against conventional IT systems like centralized databases and networks. While both manage and store data, they are built on very different foundations — from architecture and trust to transparency and performance.

Trust Model

Traditional systems depend on trusted third parties such as banks, platforms, or regulatory bodies to validate and execute transactions. Users place their confidence in these central authorities to act fairly and securely.

Blockchain takes a different path. It removes the need to trust a single entity. Instead, cryptographic proofs and consensus mechanisms like Proof of Work or Proof of Stake validate transactions. The trust shifts from individuals or institutions to the network protocol itself. Our guide on blockchain protocols explores how these models work in practice.

Cost

While blockchain networks can require significant upfront investment to design and deploy, they often reduce costs over time by automating workflows and cutting out intermediaries. For example, smart contracts remove the need for brokers or clearinghouses.

By contrast, traditional systems typically carry higher operational costs. These include licensing fees, reconciliation between multiple parties, and infrastructure expenses — all of which grow when transactions cross borders. Businesses exploring ways to reduce these overheads often look into blockchain product development as part of their strategy.

Transparency

One of blockchain’s core strengths is transparency. Every transaction is time-stamped and stored on a ledger that’s visible to participants in the network. This makes unauthorized changes or hidden actions far harder to execute.

Traditional systems are more private by design. Data access is limited to administrators or select users. While this setup offers strong privacy, it can reduce accountability — a downside in sectors where public trust is crucial. For a deeper look at transparency in blockchain ecosystems, our article on blockchain for public services shares more real-world examples.

Speed and Performance

Traditional systems generally outperform blockchains when it comes to speed. With a central server managing transactions, they can handle thousands per second, making them well-suited for operations like real-time payments or inventory updates.

Public blockchains, on the other hand, are slower because consensus requires input from many nodes. Bitcoin, for example, handles only about seven transactions per second. But technologies like Layer 2 solutions, sidechains, and Rollups are closing this gap. Our blockchain scalability solutions cover how these advancements are changing the picture.

Use Cases

Blockchain excels in environments where participants don’t fully trust each other. This makes it ideal for cross-border payments, decentralized finance, supply chain tracking, and DAOs.

Traditional systems remain the better fit for centralized scenarios where speed and control are top priorities — such as internal CRMs, ERP systems, or private databases. Businesses that need both control and traceability sometimes turn to hybrid blockchain solutions to blend these strengths.

Comparison Table: Blockchain vs Traditional Systems

| Feature | Blockchain | Traditional Systems |

| Trust Model | Trustless, decentralized consensus | Requires intermediaries and central trust |

| Cost | Lower in the long term (no middlemen) | Higher due to licensing, admin, middlemen |

| Transparency | High — public ledger | Low — controlled access |

| Speed | Slower — due to network-wide validation | Faster — single-point control |

| Use Case | Decentralized, multi-party environments | Centralized, trusted applications |

In summary, blockchain and traditional systems serve different purposes. Blockchain offers unparalleled transparency, security, and decentralization, while traditional databases excel in speed, control, and simplicity. Understanding the trade-offs helps in choosing the right solution for your specific business or technical needs.

Limitations and Challenges of Blockchain Technology

While blockchain brings exciting new possibilities, it also faces real-world challenges. Many of these limitations arise from the same qualities that make the technology powerful — decentralization, transparency, and security. Being aware of these trade-offs helps when deciding where blockchain makes sense.

Scalability and Transaction Speed

One of blockchain’s biggest hurdles is scalability. Public networks like Bitcoin process around seven transactions per second, and Ethereum handles between 15 and 30. Centralized systems, by comparison, easily process thousands. This difference comes from the need for decentralized networks to reach agreement across many nodes before confirming transactions.

Innovations like Layer 2 solutions, Rollups, and sharding aim to bridge this gap. There’s a detailed breakdown of these approaches in our article on blockchain scalability, which looks at how performance is improving without sacrificing security.

Energy Use and Consensus Models

Proof of Work networks, such as Bitcoin, are energy-intensive because they rely on miners solving complex puzzles to secure the blockchain. This ensures strong security but at a high environmental cost. Proof of Stake offers a more efficient path, selecting validators based on the tokens they stake, which dramatically reduces energy consumption. Ethereum’s shift to PoS through the Merge highlights how the ecosystem is adapting for sustainability.

For businesses weighing these models, we provide blockchain consulting services to help choose the right approach based on goals and constraints.

Regulation and Privacy

Blockchain exists across borders, but regulations don’t. Some regions are supportive, while others impose strict limits, creating uncertainty for builders and investors. If you want a clearer view of how companies are tackling this, check out our article on blockchain compliance.

Transparency — one of blockchain’s biggest strengths — can also create privacy concerns. Every transaction is visible on-chain, which isn’t ideal for sensitive data. Emerging solutions like zero-knowledge proofs and permissioned chains are helping to strike a better balance between openness and confidentiality.

Blockchain and Smart Contracts

Smart contracts are one of blockchain’s most important innovations. These self-executing programs run automatically when certain conditions are met, enabling secure, transparent digital agreements without relying on intermediaries.

What Are Smart Contracts?

A smart contract is code stored on a blockchain that enforces rules and processes transactions once predefined conditions are satisfied. Unlike traditional contracts, smart contracts don’t need lawyers or brokers to ensure execution. The logic is baked into the code, and once deployed, the contract runs as written — tamper-proof and automatic.

For example, a smart contract might be designed so that when Person A sends 1 ETH, Person B automatically receives ownership of a digital asset. There’s no room for dispute or manual intervention. This concept is key to understanding how decentralized systems operate, as explored in our article on what smart contracts are and how they work.

How Smart Contracts Work (Ethereum Example)

Ethereum pioneered smart contracts at scale. Developers write them using Solidity, its native language, and deploy them to the Ethereum Virtual Machine (EVM). Once live, these contracts are:

- Immutable: The code can’t be changed.

- Transparent: Anyone can review it on-chain.

- Autonomous: It runs independently once triggered.

Every interaction — from updating data to emitting events — is verified by the network and permanently recorded. If you’re exploring blockchain systems, you might also be interested in our guide to blockchain platforms that support smart contract development.

Use Cases

Smart contracts enable a wide range of applications:

- DeFi protocols like Aave and Uniswap use them for lending, trading, and yield farming.

- Insurance solutions trigger payouts automatically when conditions (like flight delays) are met.

- Gaming and metaverse projects power player-owned economies.

- DAOs rely on smart contracts to automate governance, treasury management, and voting.

Teams designing blockchain-based products often turn to services like our custom blockchain app development to ensure security, scalability, and compliance.

Benefits and Limitations

Benefits

- Trustless automation with no intermediaries

- Open-source logic that anyone can audit

- Lower administrative costs and faster execution

Limitations

- Bugs in code are permanent unless the contract includes upgrade logic

- Vulnerabilities can lead to exploits, as seen in cases like The DAO hack

- More complex contracts can increase gas fees and network congestion

As smart contracts evolve, so do their capabilities — especially with upcoming advancements in account abstraction, privacy layers, and cross-chain interoperability. For businesses and developers, they offer a programmable, secure foundation for creating decentralized applications (dApps) that can reshape digital commerce, governance, and trust.

Blockchain Security and Risks

Blockchain is often praised for its security — and for good reason. Cryptography, decentralization, and data immutability work together to create systems that are incredibly resistant to tampering. But while the technology reduces many risks associated with traditional systems, it introduces new ones that builders and users must understand.

Immutable Records and Encryption

Every block in a blockchain is cryptographically linked to the one before it. This chaining makes it nearly impossible to alter past data without rewriting the entire chain — a task that would require overwhelming control of the network. Transactions are signed using private keys, which verify authenticity and prevent unauthorized changes.

If you’re interested in how this core design supports real-world systems, our article on blockchain for cybersecurity explores additional examples of where this security model excels.

51% Attacks: Risk in PoW Networks

Proof of Work (PoW) chains like Bitcoin rely on miners solving puzzles to validate blocks. If a miner or group gains more than 50% of total hash power, they could theoretically rewrite transaction history or double-spend coins. This is called a 51% attack. While it’s practically impossible on large networks due to the cost and coordination required, smaller PoW chains face more exposure.

For enterprises planning blockchain infrastructure, our enterprise blockchain development service helps design systems with robust security against such threats.

Smart Contract Bugs and Wallet Risks

Smart contracts are powerful, but their immutability means bugs are permanent unless upgrade paths are built in. Errors in contract logic have led to millions in losses, as seen in incidents like the DAO hack. Because smart contracts are public, bad actors can study them just as easily as developers.

Users also face risks unrelated to blockchain tech itself — phishing scams, malware targeting private keys, and mistakes like sending funds to the wrong address. Once a transaction is made, it can’t be reversed. If you want to dig deeper into where these vulnerabilities emerge, check out our article on smart contract security.

Tip: How to Keep Your Crypto Secure

- Use hardware wallets to store private keys offline

- Enable two-factor authentication on accounts

- Never click untrusted links or download suspicious files

- Double-check wallet addresses before sending

- Keep seed phrases private and backed up securely

As blockchain adoption expands, better audit tools, insurance options, and wallet designs are helping users stay safer. But ultimately, the strongest defense combines solid technology with good user habits.

Future of Blockchain Technology

Blockchain is no longer just about powering cryptocurrencies. It’s evolving into the backbone of a more open, secure, and decentralized digital economy. The next phase of this technology focuses on infrastructure that enables transparency, user control, and automation at a global scale.

From Crypto to Web3 Infrastructure

Blockchain is central to the rise of Web3 — a vision for an internet where users, not corporations, control their data, identity, and digital assets. Decentralized applications (dApps) built on blockchain allow people to own and govern the platforms they use. Tokens provide not just utility but also ownership and decision-making power.

You can explore more about how this shift supports digital sovereignty in our article on decentralized applications.

Layer 2 Scaling and Interoperability

One of blockchain’s biggest hurdles is scalability. Layer 2 solutions — like Optimistic Rollups, zk-Rollups, and sidechains — are making transactions faster and cheaper without compromising security. These technologies help blockchains like Ethereum process more transactions while keeping fees low.

At the same time, interoperability protocols such as Polkadot and Cosmos allow different blockchains to exchange data and assets. This unifies previously siloed systems into a more connected network, similar to the evolution of the internet itself.

For projects aiming to build on this foundation, our Polkadot blockchain development services can help create interoperable, scalable solutions.

Institutional Adoption Is Accelerating

Governments and large enterprises are rapidly integrating blockchain into real-world operations. Central banks are testing Central Bank Digital Currencies (CBDCs) to modernize payments. Firms like Visa and IBM are using blockchain for supply chain tracking, identity management, and secure payments.

This growing institutional interest is helping blockchain mature beyond speculative use, bringing legitimacy and stability to the ecosystem. If you’re curious about the broader impact on industries, our article on enterprise blockchain solutions provides a deeper dive.

Blockchain Beyond Crypto: AI, IoT & Machine Economy

Blockchain’s role in the future goes well beyond finance. As AI and IoT technologies advance, blockchains could enable a machine economy where devices and software agents transact on their own. Smart contracts might automate energy sales from solar panels or manage payments between autonomous vehicles and charging stations.

Blockchain also offers transparency for AI decision-making, making it easier to audit how algorithms use data — a critical factor in building trust in AI systems.

What’s Next?

As blockchain matures, the focus is shifting to usability, sustainability, and regulation. The technology is well on its way to becoming essential infrastructure for digital life, not just a tool for cryptocurrency. Its integration with Web3, AI, IoT, and enterprise systems is only just beginning.

Frequently Asked Questions About Blockchain

Is blockchain the same as Bitcoin?

Blockchain and Bitcoin are often confused, but they aren’t the same. Bitcoin is a digital currency built on blockchain technology. Blockchain itself is the underlying distributed ledger that securely records and verifies data. Beyond cryptocurrencies, blockchain is now used in many other fields, including supply chain management and digital identity systems.

Can blockchain be hacked?

Blockchain is designed for security, using cryptographic techniques and decentralization to make unauthorized tampering extremely difficult. That said, no system is perfectly secure. Smaller blockchains are more vulnerable to 51% attacks, and weaknesses in smart contracts or user wallets can be exploited. If you want to explore these risks in depth, see our guide on smart contract security.

Who owns the blockchain?

No one person or organization owns a blockchain. These networks are decentralized, so anyone can join by running a node, validating transactions, or contributing in other ways. Open-source code and community governance models ensure shared decision-making, especially in public chains like Bitcoin or Ethereum.

What’s the difference between blockchain and a database?

Traditional databases are centralized, controlled by a single authority, and data can usually be modified or deleted by admins. Blockchain, on the other hand, records data in blocks that are linked together in an immutable chain. Once data is added, it can’t be changed without broad network consensus. This makes blockchain ideal for applications where verification and transparency matter most. We help businesses explore these differences when building custom solutions — learn more about our blockchain consulting services.

How is blockchain used in real life?

Blockchain is already being applied across industries. It powers cross-border payments, decentralized finance (DeFi), healthcare record security, tamper-proof voting, and even NFT marketplaces. As the technology evolves, its real-world use cases continue to expand beyond cryptocurrency.

Conclusion: Is Blockchain the Foundation of the Future?

Blockchain has grown far beyond its origins in cryptocurrency. Today, it serves as a foundation for decentralized systems that prioritize transparency, security, and automation across industries. Its core strengths — immutability, distributed trust, and programmability — are reshaping how we think about value exchange, digital ownership, and governance.

By eliminating intermediaries, blockchain enables peer-to-peer coordination through mechanisms like smart contracts, DAOs, and token economies. These innovations open doors for more inclusive and efficient digital systems, whether in finance, logistics, or governance. If you’re interested in how this technology powers decentralized finance, our guide on DeFi apps offers a deeper look.

The technology’s future will be defined by its ability to overcome current limitations. Advances in Layer 2 scaling, cross-chain interoperability, and regulatory clarity are making blockchain more practical for large-scale use. We’re seeing growing interest in tokenization of assets, which highlights how blockchain blends with real-world economics.

At Webisoft, we help organizations design and deploy blockchain solutions that are ready for this next era. Our blockchain app development services focus on creating scalable, secure applications that bring these ideas to life.

This is only the beginning. As blockchain continues to mature and integrate with technologies like AI and IoT, it’s positioned not just to support the future of the digital economy — but to help shape what comes next.