Avalanche Bridge: Features, Use Cases, and Costs

- BLOG

- Blockchain

- June 26, 2025

In Q1 2025, Avalanche bridges processed over $1.2 billion in cross-chain volume, outperforming Polygon, Optimism, and Solana combined in bridge inflows. That’s not a headline, it’s a shift in how value moves across blockchains.

At the center of this is the Avalanche bridge, a system built to transfer assets like BTC, ETH, and USDC into Avalanche with low fees, near-instant speed, and full cryptographic security.

It’s a purpose-built system that locks assets on their native chains, then issues fully-backed tokens on Avalanche’s blazing-fast C-Chain.

If you’re tired of slow transfers and high gas, this guide shows how Avalanche bridges do it differently and why more users are switching fast.

Contents

- 1 A Quick Overview of Avalanche

- 2 What Is the Avalanche Bridge?

- 3 How An Avalanche Bridge Works?

- 4 Key Features of Avalanche Bridge

- 5 Why Avalanche Is Great For Blockchain Bridging

- 6 Avalanche Bridge Options: Quick Summary Table

- 7 How To Bridge To And From Avalanche Bridge?

- 8 How to Select the Best Bridge for an Avalanche?

- 9 Partner with Experts to Accelerate Your Blockchain Success.

- 10 Use Cases of Avalanche Bridges

- 11 Avalanche Bridge Fees and Speed Comparison

- 12 How is The Avalanche Bridge™ Secured?

- 13 Challenges While Bridging Avalanche Blockchain – How To Overcome

- 14 The Future of Avalanche Bridges

- 15 How Webisoft Helps In Avalanche Bridge Needs?

- 16 Partner with Experts to Accelerate Your Blockchain Success.

- 17 In Closing

- 18 Frequently Asked Questions

A Quick Overview of Avalanche

Avalanche is a decentralized, open-source blockchain platform launched in September 2020 by Ava Labs. It supports fast and secure decentralized applications.

Avalanche operates with three integrated blockchains:

- X-Chain

- C-Chain

- P-Chain

These chains handle asset transfers, smart contracts, and validator coordination separately. This design boosts efficiency, flexibility, and speed.

The network uses the Avalanche Consensus, combining elements of classical and Nakamoto methods.

This offers thousands of transactions per second with near-instant finality. Avalanche aims to serve real-world financial use cases with its scalable and reliable infrastructure.

Its development team includes researchers from Cornell University and key figures in blockchain innovation.

What Is the Avalanche Bridge?

The Avalanche Bridge is a decentralized protocol designed to facilitate the secure transfer of digital assets between the Avalanche network and other major blockchains. Such as Ethereum and Bitcoin.

By enabling seamless cross-chain communication, the bridge allows users to move assets like tokens and NFTs across networks.

It is even done without relying on centralized exchanges. For this, the bridge utilizes smart contracts and advanced cryptographic techniques. It helps ensure the integrity and security of the connected transactions.

Launched in 2021, the Avalanche Bridge replaced an older version with faster speeds, lower gas costs, and broader token support.

It introduced Intel SGX technology to protect transaction data during bridging.

How An Avalanche Bridge Works?

The Avalanche bridging supports cross-chain transfers between Avalanche and multiple blockchains, including Ethereum, Bitcoin, and others. It uses a mix of smart contracts, secure hardware, and validators to manage each transfer.

When assets are sent from an external chain to Avalanche, they are first locked in a dedicated address. For Bitcoin, this address is controlled by a secure enclave using Intel SGX technology.

For Ethereum-based assets, smart contracts handle the locking mechanism.

Once the transaction meets confirmation requirements, Bridge Nodes detect it and pass the data to the enclave.

The enclave then creates a wrapped version of the asset on Avalanche. For many, these tokens carry a “.b” or “.e” suffix to show their origin.

BTC.b represents Bitcoin; USDC.e or ETH.e represent Ethereum-based tokens. Each wrapped token is fully backed by the original asset held on the source chain.

Moving assets back requires the wrapped token to be destroyed on Avalanche. Once burned, the enclave or smart contract releases the original asset to the destination wallet on its native chain.

Webisoft develops the smart contracts that lock and unlock tokens, implement secure enclave interactions, or build user-friendly interfaces for bridging assets.

You can learn more from the avalanche support page for this.

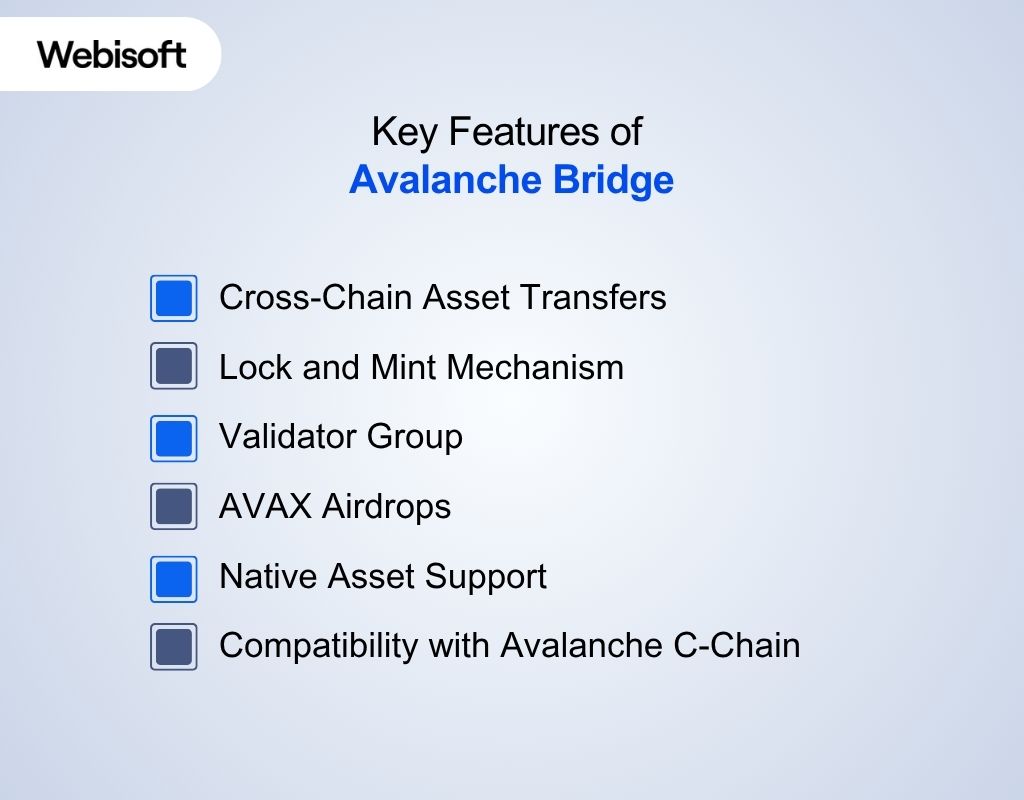

Key Features of Avalanche Bridge

Avalanche Bridge supports secure, high-speed transfers between Avalanche and external chains. It uses smart architecture and decentralized validation to expand multi-chain connectivity and utility.

Cross-Chain Asset Transfers

The bridge moves assets between Avalanche and other blockchains like Ethereum and Bitcoin. It supports both fungible and non-fungible tokens.

Transfers follow strict protocols for confirmations, wrapping, and delivery, maintaining security and network consistency throughout the process.

Lock and Mint Mechanism

Assets on the source chain are locked in verified addresses. Wrapped tokens are minted on Avalanche with equivalent value.

When returned, the wrapped asset is burned, and the original is released. This approach maintains strict one-to-one asset integrity.

Validator Group (“Wardens”)

A group of validators called Wardens tracks, verifies, and submits cross-chain transaction data. They secure bridging logic and confirm events independently. This system distributes trust and reduces risk from centralized control or single points of operational failure.

AVAX Airdrops

AVAX tokens are occasionally distributed to users bridging into Avalanche. These airdrops serve as welcome incentives and help cover initial transaction costs. It improves interaction with decentralized apps and smart contracts on the Avalanche C-Chain.

Native Asset Support

The bridge supports widely used tokens like BTC, ETH, USDT, and USDC. Each is converted into a wrapped format suitable for Avalanche.

These assets work with lending platforms, NFT projects, trading protocols, and liquidity systems on the network.

Compatibility with Avalanche C-Chain

All bridged tokens function on the Avalanche C-Chain. This chain is fully EVM-compatible, supporting smart contracts, dApps, and major wallets like MetaMask.

It also simplifies interaction with DeFi platforms and token management tools.

Why Avalanche Is Great For Blockchain Bridging

Avalanche combines high performance, robust security, and wide compatibility, making it a strong foundation for cross-chain asset transfers across Web3 ecosystems.

Fast Transaction Speed

The Avalanche network reaches sub-second finality, typically between 450 to 600 milliseconds. By comparison, Ethereum transactions may take 15 seconds or more.

This speed gives Avalanche a distinct advantage in time-sensitive operations like arbitrage, swaps, or NFT minting across chains.

Low Transaction Fees

Avalanche fees average less than $0.01 per transaction on the C-Chain. Even during peak usage, costs rarely exceed $0.10. It makes the bridging significantly cheaper than Ethereum, where average gas fees can exceed $2–$20 depending on network congestion.

This pricing structure supports frequent bridging without heavy costs.

For cost-effective and reliable blockchain solutions, trust Webisoft and optimize your bridging operations with expert support for your needs.

EVM Compatibility

Avalanche’s C-Chain supports the Ethereum Virtual Machine (EVM), making it compatible with Ethereum-based tools, wallets, and dApps.

Bridged assets retain full utility within this environment, which reduces development overhead and simplifies integration for existing projects.

Interoperability

Avalanche Bridge supports connections to major blockchains like Ethereum and Bitcoin. Its design supports multiple token standards and contract types.

This flexibility makes Avalanche a strong participant in the broader multi-chain DeFi and NFT landscape.

Secure Architecture

Avalanche Bridge uses smart contracts and, in the case of Bitcoin, Intel SGX technology for asset custody.

Validator nodes monitor all activity. This layered design safeguards assets and transaction data during each step of the bridging process.

Growing Ecosystem

Avalanche hosts a rapidly expanding ecosystem of DeFi, GameFi, and NFT platforms. Bridged assets can immediately engage with these protocols.

Ecosystem growth increases liquidity, use cases, and value opportunities for assets entering from other blockchains.

Avalanche Bridge Options: Quick Summary Table

When it comes to bridging assets to and from Avalanche, several reliable options are available. Each bridge offers unique features, supports different blockchains, and varies in speed, security, and fees.

The table below provides a quick overview of the leading Avalanche-compatible bridges to help you choose the best fit for your needs.

| Bridge | Type | Best For | Chains Supported |

| Core Bridge | Official | ETH, USDC.e from Ethereum | Ethereum ⇄ Avalanche |

| Stargate Finance | Decentralized (LayerZero) | Stablecoins (USDT, USDC) | Ethereum, Avalanche, BSC, L2s |

| Synapse Protocol | Decentralized | Alt-chains and advanced users | 20+ chains including Polygon |

| Jumper Exchange | Aggregator | Auto-routing + token swap + bridge | 19+ chains |

| MetaMask Bridge | Wallet-integrated | Beginners (simple ETH, USDC) | 6 chains (ETH, BSC, AVAX, etc.) |

| CEX Transfers | Centralized | Non-tech users | Binance, Coinbase, KuCoin, etc. |

How To Bridge To And From Avalanche Bridge?

Avalanche supports multiple bridging tools, both official and third-party.

Each option offers unique features for moving AVAX and other tokens between Avalanche and external networks. Such as Ethereum, Bitcoin, and popular Layer 2 chains.

1. Core App (Official Avalanche Bridge)

Core is Avalanche’s official wallet and bridge, developed by Ava Labs for smooth bridging and staking.

Steps to bridge to Avalanche:

- Download the Core wallet browser extension or mobile app and install it on your device.

- Create a new Avalanche wallet or connect an existing MetaMask wallet.

- Open the app, click “Connect Wallet,” and authorize the selected provider.

- Go to the Portfolio tab and select “Bridge” from the right-side options.

- Choose the blockchain you want to bridge from (Ethereum or Bitcoin).

- Pick the token you wish to move and enter the exact amount.

- Follow the prompts to approve and confirm the transaction from your wallet.

- Wait until the transaction is confirmed on both networks.

- Once verified, your bridged tokens will appear in your Avalanche wallet.

2. Stargate Finance

Stargate uses omnichain messaging to transfer tokens in their native form across chains.

Steps to use Stargate:

- Visit the Stargate Finance website and connect your wallet securely.

- Navigate to the “Transfer” section using the top menu bar.

- Set the source and destination chains for your transaction.

- Choose your token and enter the desired transfer amount.

- Review any notices about token support on Avalanche.

- Confirm and approve the transfer using your connected wallet.

- Wait for the network to process the request and deliver your tokens on Avalanche.

3. Synapse Protocol

Synapse offers modular bridging across 19+ networks using an optimistic PoS model.

Steps to use Synapse:

- Open the Synapse Protocol website and click “Connect Wallet.”

- Select “Enter Bridge” to access the bridging interface.

- Choose your source network and Avalanche as the destination.

- Pick the asset you want to bridge and specify the amount.

- Approve the selected asset for usage in the protocol.

- Review the transaction and sign it through your wallet.

- Once confirmed, the asset will arrive in your Avalanche wallet.

4. Jumper Exchange

Jumper aggregates multiple bridges and route swaps in one unified interface using LI.FI.

Steps to use Jumper:

- Go to Jumper.exchange and connect your wallet.

- In the “From” section, select the source chain and token.

- Choose Avalanche as the destination chain for the transfer.

- Optionally, set a different token to receive on the destination side.

- Click “Exchange” and review the suggested bridging route.

- Select the preferred option and initiate the transaction.

- Confirm through your wallet and wait for the final delivery on Avalanche.

5. MetaMask Bridge

MetaMask offers built-in bridging through third-party protocols, accessible from within the wallet interface.

Steps to use MetaMask Bridge:

- Open your MetaMask wallet and go to the “Bridge” section.

- Choose the source and destination networks from the dropdown menus.

- Select your token and enter the amount for transfer.

- View route suggestions and select “Choose a different quote” if needed.

- Approve the transaction and follow prompts to confirm.

- Wait for the transaction to complete. Your bridged asset will show up on Avalanche.

Note: MetaMask charges a 0.875% bridging fee.

6. Centralized Exchanges (CEXs)

Exchanges like Binance or Coinbase support direct cross-network transfers with fewer steps and predictable timing.

Steps using a centralized exchange:

- Deposit the desired token into your exchange wallet from any supported network.

- Navigate to the withdrawal section on the exchange platform.

- Select Avalanche as the network for your token withdrawal.

- Input your Avalanche wallet address carefully and verify all details.

- Submit the withdrawal and wait for the exchange to process it.

- Once confirmed, your funds will arrive directly in your Avalanche wallet.

How to Select the Best Bridge for an Avalanche?

Choosing the right bridge depends on what you’re moving, where it’s going, and what trade-offs matter most on cost, speed, or asset support.

1. Check Asset Compatibility

Not all bridges support every token. For example, Core Bridge handles BTC and ETH, while Stargate supports stablecoins like USDC. Always check the bridge’s supported asset list before starting the transfer.

2. Confirm Destination Chain Support

Some bridges only support certain chains. MetaMask Bridge, for instance, does not support Bitcoin or some Layer 2s. Synapse, on the other hand, supports over 19 networks, including Arbitrum and Optimism.

3. Compare Fees and Network Costs

Fees vary widely. MetaMask adds a 0.875% fee, while Core Bridge charges a fixed $3 (BTC) or $20 (to BTC). Always consider this along with on-chain gas fees before choosing a bridge.

4. Evaluate Speed and Finality

Core Bridge with Bitcoin can take 30 minutes or more due to Bitcoin confirmations. Stargate and Synapse are faster, typically taking 1–3 minutes, especially when bridging ERC-20 tokens between EVM chains.

5. Consider Interface and Wallet Support

Some tools, like Core, offer native support for Avalanche wallets, while others work best with MetaMask. Jumper Exchange offers a user-friendly interface with routing logic, ideal for beginners and advanced users alike.

If you want a trusted team with proven expertise to make your blockchain bridging effortless and secure, expert guidance is just a step away.

Partner with Experts to Accelerate Your Blockchain Success.

Get Professional Support and Launch Your Project Today!

Use Cases of Avalanche Bridges

1. Cross-Chain DeFi (Decentralized Finance)

Users shift assets like USDC, ETH, or BTC into Avalanche to tap DeFi tools that offer lower fees and faster settlement. Bridged tokens appear as wrapped assets (e.g., USDC.e, BTC.b) on Avalanche’s C-Chain.

These assets integrate with smart contracts used in platforms such as Trader Joe, BENQI, and Aave. Fast finality.

It reduces front-running risk, and low gas costs improve returns from trading, lending, or liquidity farming.

As of early 2024, Avalanche’s DeFi ecosystem maintained over $1.3 billion in total value locked (TVL), largely driven by assets bridged from Ethereum and other chains.

Example

A trader moves USDC from Ethereum to Avalanche via Core, then deposits it into BENQI. They begin earning interest with lower network fees and quicker transaction cycles.

2. NFT Transfers Between Marketplaces

Bridging NFTs to Avalanche supports artists, collectors, and games moving collections across ecosystems. Users can send NFTs from Ethereum to Avalanche to mint, list, or trade on Avalanche-native platforms like Kalao, Campfire, or Joepegs.

The bridge converts NFTs into Avalanche-compatible tokens while preserving metadata and ownership. This helps projects tap into faster, cheaper trading and expand into new communities without redeploying the entire collection.

Joepegs, Avalanche’s largest NFT marketplace, surpassed $5 million in trading volume within a short time. It is supported heavily by bridged collections and cross-chain minting campaigns.

Example

An artist bridges a collection from Ethereum to Avalanche to list it on Joepegs. Buyers pay low fees, and the NFTs stay tied to the original smart contract.

3. Stablecoin Transfers for Cross-Chain Liquidity

Stablecoins like USDC and USDT are frequently bridged into Avalanche to fund lending platforms, liquidity pools, and real-time trading strategies. The tokens arrive as wrapped assets, ready for immediate use on Avalanche’s C‑Chain.

Users shift capital into protocols like Platypus, Curve, or Aave to avoid higher transaction fees and slower settlement found on other chains.

Bridge finality supports fast redeployment of funds and better capital efficiency in high-volume stablecoin markets.

As of Q1 2025, stablecoins on Avalanche surpassed $1.9 billion, with USDC growing 42.7% quarter-over-quarter

Example

A DeFi treasury bridges USDC from Ethereum to Avalanche using Core.

The capital moves directly into Curve Finance for stable swaps with reduced slippage and deep on-chain liquidity.

4. Multi-Chain Asset Management

Investors and protocols develop this blockchain bridge to consolidate assets from various chains into one wallet or platform.

Assets bridged into Avalanche can be tracked, managed, and deployed from a single interface across DeFi, NFTs, and staking tools.

This streamlines portfolio handling without juggling multiple wallets or dealing with high gas fees. It also reduces exposure to delays or fragmentation across networks, giving clearer control over balances and on-chain positions.

Example

An asset manager bridges ETH, USDC, and BTC.b into Avalanche. They monitor and rebalance the portfolio using Core and interact with different protocols from one dashboard.

5. Cross-Chain Gaming and Virtual Economies

Game developers use Avalanche bridges to move tokens, NFTs, and in-game assets between chains for better performance and lower costs. Avalanche’s fast finality and low fees support smooth gameplay, on-chain item trades, and scalable token economies.

Projects migrate assets from Ethereum or Layer 2s into Avalanche to unlock better UX, avoid congestion, and reach new users.

NFTs bridged to Avalanche become usable across gaming platforms that support native smart contract interactions.

Example

A Web3 game bridges character NFTs and in-game tokens to Avalanche, enabling faster item trades and reducing transaction costs for players across regions.

6. Institutional and Enterprise Solutions

Institutions bridge assets to Avalanche for faster settlement, compliance testing, and infrastructure trials.

Avalanche’s subnets and bridge architecture support private asset issuance, pilot programs, and integrations with enterprise-grade custodians and wallets.

Bridging supports use cases like tokenized treasury transfers, disaster relief funds, and digital ID trials, especially where blockchain interoperability is required.

Avalanche’s structure helps maintain high throughput while reducing operating costs and execution delays.

Example

A financial firm bridges tokenized bonds from Ethereum to a regulated Avalanche subnet, where they conduct testing with faster confirmation and lower risk of on-chain congestion.

Avalanche Bridge Fees and Speed Comparison

When bridging assets to and from Avalanche, fees and transfer times vary depending on the source and destination chains.

The table below breaks down typical costs and durations for popular transfer routes so you can choose the most efficient and cost-effective option for your needs.

| Transfer Direction | Fee Structure | Approximate Cost (for $25,000) | Time Taken for Transfer |

| Ethereum → Avalanche (ETH, USDC) | 0.025% (min $3, max $250) | $6.25 | 10–15 minutes (Ethereum finality) |

| Avalanche → Ethereum (AVAX, USDC) | 0.1% (min $12, max $1,000) + Ethereum gas fees | $25 + gas fees | 10–15 minutes (Ethereum finality) |

| Bitcoin → Avalanche (BTC) | Flat $3 (paid in BTC) | $3 | Tens of minutes (Bitcoin confirmations) |

| Avalanche → Bitcoin (BTC) | $20 + Bitcoin network fee (~$2 avg.) | ~$22 | Tens of minutes (Bitcoin confirmations) |

| Binance Smart Chain → Avalanche | Varies; generally low (~0.1–0.2%) | Typically <$5 | A few minutes |

| Polygon → Avalanche | Varies, generally low | Typically <$5 | A few minutes |

| Avalanche → Polygon | Varies, generally low | Typically <$5 | A few minutes |

How is The Avalanche Bridge™ Secured?

The Avalanche bridge security is confirmed through a combination of hardware-based protection, decentralized monitoring, and strict transaction validation.

It uses Intel SGX technology to protect private keys and bridge operations during Bitcoin transfers.

This hardware enclave runs a locked-down environment where malicious access is blocked.

Bridge Nodes, often called Wardens, track and report transactions. They verify on-chain events across supported networks and deliver proofs to the SGX enclave.

For Ethereum-based assets, the system relies on audited smart contracts and trusted message relayers.

No single party controls the bridge. Its security model spreads responsibility across multiple validators and layers. This structure reduces risk, protects locked assets, and maintains consistent network performance during cross-chain activity.

If you want to ensure your blockchain bridging solutions are secure, efficient, and reliable, partnering with the experienced team at Webisoft can provide the expertise and support you need.

Challenges While Bridging Avalanche Blockchain – How To Overcome

While Avalanche offers speed and low cost, bridging assets still involves technical and strategic challenges. Understanding them helps reduce delays, avoid losses, and improve your cross-chain experience.

1. High Ethereum Gas Fees

Bridging assets from Ethereum can become extremely costly during peak congestion. Even simple transfers may cost $20–$100 due to gas spikes. This affects small users the most.

Solution: Bridge during lower traffic periods or use Layer 2 chains like Arbitrum or Optimism with bridges that support Avalanche. They offer similar token support at much lower fees.

2. Long Confirmation Delays

Bitcoin and Ethereum both require multiple block confirmations. Bitcoin, in particular, may take 45–60 minutes for one transaction. This slows down asset availability on Avalanche.

Solution: Use liquidity-based bridges like Stargate or Synapse for ERC-20 tokens. These finalize transfers faster using pooled assets and do not depend on long confirmation cycles.

3. Unsupported Tokens or Networks

Not all tokens or chains are available on every bridge. You may find your asset blocked or unsupported mid-process, risking confusion or failed attempts.

Solution: Use Jumper Exchange to route your transfer. It detects bridge compatibility for both token and network, and displays available options clearly before you commit.

4. Wallet Connection Errors

Browser wallets like MetaMask and Core sometimes fail to connect with bridge apps. This blocks transactions or causes failed wallet prompts.

Solution: Manually select the correct network in your wallet. Clear your browser cache and update your wallet extension. Avoid using private browsing or multiple wallet tabs.

5. Asset Confusion (.e vs .b Tokens)

Avalanche uses suffixes like .e and .b to mark bridged assets. Many users mistake them for duplicates or different tokens, causing wallet confusion or contract errors.

Solution: Always confirm token contract addresses on SnowTrace or the Core app. Use only verified bridge platforms to avoid fake tokens or mismatched wallet imports.

The Future of Avalanche Bridges

Bridging on Avalanche is evolving rapidly to meet your growing multi-chain needs.

With a focus on speed, security, and seamless ecosystem integration, these upcoming features will make your cross-chain experience more efficient and user-friendly.

What You Can Expect from the Future of Avalanche Bridges:

- Native Support for More Layer 2 Chains: Soon, you’ll be able to transfer assets directly from Layer 2 networks like Base and zkSync without detouring through Ethereum, saving you time and fees.

- One-Click Swaps + Bridging Integrations: Imagine swapping tokens and bridging them in a single, unified step, making your interactions with dApps and wallets smoother and more intuitive.

- Private Bridge Infrastructure for Institutions: If you’re part of an enterprise or institution, dedicated bridge layers on enterprise subnets will enable secure, regulated asset transfers across permissioned networks.

- Improved Wrapped Asset Tracking: Enhanced tools will help you easily identify wrapped (.e, .b) and native tokens, giving you clearer on-chain portfolio visibility and reducing confusion.

- Faster Confirmation Windows: Advances in relaying and proof validation will cut down required block confirmations, significantly reducing your wait times for transfers.

- Stronger MEV Protection: Future bridges will integrate protections against miner extractable value (MEV) risks, safeguarding your high-value asset transfers from manipulation.

How Webisoft Helps In Avalanche Bridge Needs?

Webisoft is your trusted partner for building, optimizing, and maintaining Avalanche bridges.

Our expert team delivers end-to-end solutions to ensure secure, fast, and cost-effective cross-chain transfers. Here’s how we support your project:

- Webisoft designs custom bridge architectures for transferring tokens, data, or hybrid assets, optimized for the Avalanche network.

- We implement robust smart contracts and strong security protocols. It protects your asset at every stage of the bridging process.

- Our solutions take full advantage of Avalanche’s high-speed infrastructure and low transaction fees. You will ensure real-time, affordable transfers.

- User-Friendly Interfaces: We develop intuitive user interfaces, making cross-chain transfers accessible for your Avalanche users.

- From planning and deployment to ongoing maintenance, Webisoft ensures the reliability of your Avalanche bridge solution.

Organizations also benefit from our expertise in integrating DeFi protocols, liquidity management, and compliance best practices. Experience the full potential of Avalanche’s ecosystem.

Partner with Experts to Accelerate Your Blockchain Success.

Get Professional Support and Launch Your Project Today!

In Closing

The Avalanche bridge™ stands out as a fast and cost-effective solution for transferring assets between Avalanche and other major blockchains like Ethereum and Bitcoin.

Its robust security model, utilizing Intel SGX enclaves and decentralized wardens, ensures your assets remain protected throughout the process.

As Avalanche’s ecosystem continues to grow, the bridge will play a pivotal role in enabling seamless cross-chain interoperability, fueling DeFi innovation, and multi-chain adoption.

If you’re looking to build or scale your blockchain projects with reliable cross-chain solutions, Webisoft’s expert team is here to help.

Get in touch with Webisoft today and secure your seamless blockchain bridging experience!

Frequently Asked Questions

1. What wallets are compatible with the Avalanche bridge?

The Core Wallet supports full bridging for both Ethereum and Bitcoin. MetaMask can be used for Ethereum-based transfers only. For BTC, use the Core browser extension.

2. Can I use the Avalanche bridge on mobile?

Yes, the Core mobile app supports bridging for Ethereum-based assets. However, Bitcoin transfers are only available on the browser extension, not the mobile version.

3. What happens if I send unsupported tokens through the bridge?

Sending unsupported tokens may lead to failed transfers or permanent loss. Always verify token support on the bridge interface before starting any transaction.

4. Are Avalanche bridge transactions reversible?

No. Once confirmed on the source chain, transactions cannot be reversed. Always check the receiving address and transfer details before submitting.

5. Where can I track my bridging transaction?

You can track Avalanche-side activity on SnowTrace.io. For Ethereum or Bitcoin confirmations, use Etherscan.io or Mempool.space respectively. Most bridges also show status in-app.